The major trend of sterling has been downtrend that has turned into the consolidation phase from the last couple of months, accordingly, we have reserved our judgement about the consequences for GBP of a clear hawkish shift at the BoE and have been open-minded about whether we should position long GBP for the initial policy action, or short GBP for the possibility that the MPC could be about to commit a policy mistake.

As we detailed last week, UK rate expectations are appropriate from the perspective of inflation or the output gap, but conspicuously overblown when benchmarked to current UK growth. The BoE has not been much help in coming to a strategy conclusion as the explanations it has offered for soon tightening policy are unconvincing and inconsistent (inflation risks are being simultaneously attributed to a strengthening in actual growth and a decline in potential growth). But with the UK curve pricing what is tantamount to a normal hiking cycle of approximately 100bp (refer above chart), and the economy showing no overall sign of accelerating from a 1.0-1.25% growth rate, we’re inclined to believe that UK rate pricing has peaked for now, so too GBP.

Sterling was bedevilled by growing political uncertainties in the UK after Theresa May failed to shore up her position in the Conservative party conference, plus the EU Parliament declaring a lack of “sufficient progress” in the Brexit negotiations.

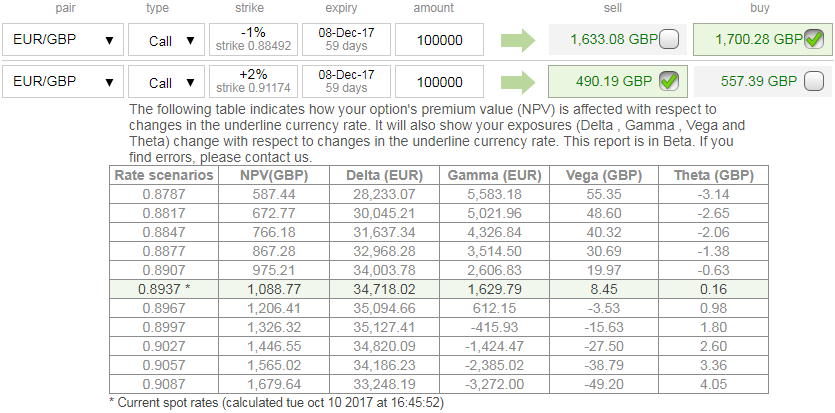

However, it is not sufficiently convinced of this to warrant a cash short in GBP; instead, we prefer to express a view of bounded pressure on GBP through a call spread with the upper strike marginally below the recent peak. Contemplating all these factors, accordingly, we’ve formulated below options strategy.

We encourage a pre-emptive long in EURGBP via a call spread as the UK curve prices close to a normal rate hike cycle which may look excessive if the MPC delivers a dovish hike in November and growth languishes near 1%.

As shown in the above diagram, buy a 2-month 0.8850-0.9150 EURGBP call spread at the net delta of 0.34 for 52bp. Spot reference 0.8939:

Currency Strength Index: FxWirePro's hourly EUR spot index has shown 142 (which is highly bullish), while hourly GBP spot index was at 73 (bullish) at 12:30 GMT. For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit:

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook