The euro has been considerably downgraded again on the heels of a dovish

ECB and more poor growth data. German GDP contracted in 2Q as expected, and our economists have subsequently revised down their growth expectations for the coming year. They have simultaneously highlighted risks of more-aggressive-than-expected ECB policy support as well; we believe ECB dovishness is likely to remain a durable theme for the currency.

On the flip side, we mark down GBP considerably versus both EUR and USD (-2.4% and -4.6% respectively across the forecast horizon). Risks of a hard Brexit have not abated, and the macro picture continues to deteriorate.

We remain short in our portfolio as we have marked down EURGBP projections, our technical analysis also signal the pair is likely to prolong range-bounded trend in long terms and continue to suggest a significant pullback is warranted in short term, but price action is not confirming this at the moment. Short-term support lies at 0.9097 levels and resistance at 0.9161 levels. The pair is forecasted to oscillate but at 0.93 by year-end and even 0.95 in 2Q’20.

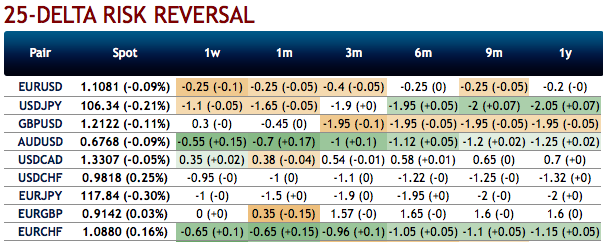

OTC Updates: Let’s just quickly glance at OTC outlook before looking at the options strategies.

Bullish neutral risk reversals of EURGBP have been observed to the broader bullish risk outlook in the FX OTC markets, this is interpreted as the hedgers are still keen on bullish risks but with mild downside risk sentiment in the near-term (refer to negative risk reversals in 1m tenors which is absolutely in line with our forecasts).

While positively skewed IVs of 3-6m tenors have been indicating upside risks, more bids are observed for OTM calls than OTM puts. This is conducive for options holders of OTM call options.

While EURGBP risk reversals of the existing bullish setup remain intact, even if you see any abrupt negative risk reversal numbers, it should not be perceived as the bearish scenario changer. Instead, below options strategy could be deployed amid such topsy-turvy outlook.

Well, contemplating the above factors, 3-way options straddle versus ITM calls are advocated seem to be the most suitable strategy for EURGBP contemplating some OTC sentiments and geopolitical aspects.

Options Strategy: The strategy comprises of at the money +0.51 delta call and at the money -0.49 delta put options of 2m tenors, simultaneously, short (1%) ITM puts of 1w tenors. The strategy could be executed at net debit but with a reduced trading cost.

Hence, on hedging as well as trading grounds, initiate above positions with a view of arresting potential FX risks on either side but slightly favoring short-term bearish risks. Courtesy: Sentrix, JPM & Saxobank

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges