The European Central Bank (ECB) is meeting this Thursday, 8th December to decide monetary policy. The ECB will also publish updated projections on Thursday that will include a first outlook for 2019. Draghi is expected to tread carefully after last year’s December policy announcement fell short of investor expectations and markets sold off.

The central bank officials have committed to keep their stimulus in place until the recovery is self-sustained and inflation on an upward trend. That said, the ECB's incentive to press on with additional easing to help stabilize financial markets must be weighed against economic realities.

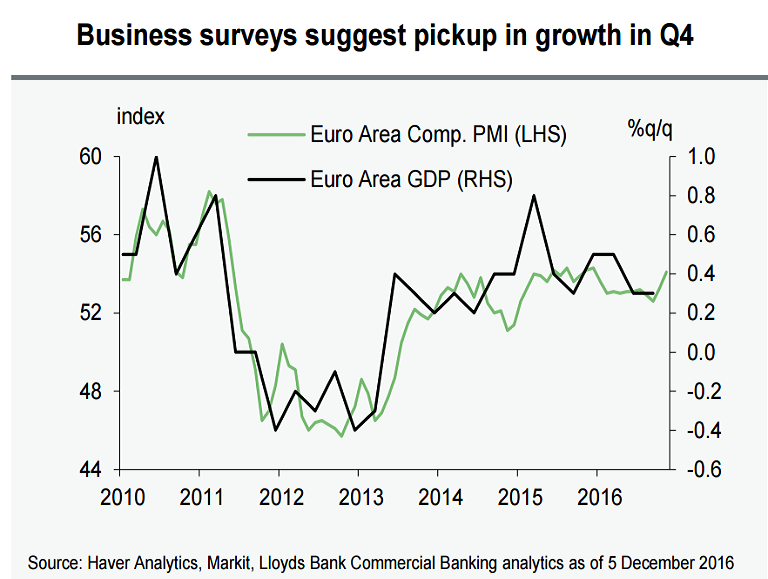

The overall euro zone economy is developing largely as expected since the release of its September forecasts and surveys have been reasonably buoyant heading into the fourth quarter. Data published by Markit Economics on showed on Monday signs of steady fourth quarter growth and indications that eurozone inflationary pressures are rising. Unemployment dropped to the lowest level in seven years in November and manufacturing activity accelerated.

“It will not be a certain inflation level alone that will make the ECB stop easing. It’s the broader economic and inflation picture including inflation expectations,” said Holger Sandte, chief European analyst at Nordea Markets in Copenhagen.

Expectations that the ECB will announce a six-month extension of its massive, trillion-euro bond-buying program on Thursday have risen in the wake of Italian PM Renzi's resignation in the early hours of Monday after losing the referendum. Looming elections in Europe will deter governments from overhauling their economies, keeping the onus on the ECB to ensure sufficient stimulus.

It is worth noting, that President Draghi recently stated that the ECB could change the amount of monthly purchases or the length of time of the purchases. Markets will focus on any further indicative comments from President Draghi at the Eurogroup ministers gathering Monday in Brussels.

"Our baseline expectation is for the ECB to announce a six-month extension to its asset purchase programme to September 2017 and to maintain its monthly purchases of €80bn. The ECB is expected to reveal technical changes to the asset purchase programme to address a potential scarcity of assets. It could announce an increase in issue limits and the removal of the deposit rate floor." said Lloyds Bank in a report.

Euro recovered from the initial slump post-Italian referendum result. EUR/USD pared losses from session lows at 1.0504 to trade at 1.0698 at 1200 GMT. At the same time, FxWirePro's Hourly EUR Spot Index was at 113.222 (Highly bullish), while Hourly USD Spot Index was at -44.5709 (Neutral). For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic  Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action

BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action