Euro crosses are struggling ahead of the main event which is the ECB policy announcement at 12:45GMT and Christine Lagarde’s maiden press conference from 13:30GMT. EURJPY has been gaining from the last 3-4 days, the pair spiked from the lows of 119.991 levels to the current 120.931 levels. However, the major downtrend of this pair remains intact 121.500 levels.

The fact that for ECB President Christine Lagarde everything to do with monetary policy is uncharted territory means for the market that the two sides will have to get to know and used to each other first.

No change to policy settings are expected today after the announcement in September of a (contentious) package of measures, including lower interest rates and the resumption of QE.

It appears that the bar to more ECB stimulus is high, with a number of officials voicing concerns about policy side effects. Moreover, Lagarde will be keen to heal divisions among policymakers and will call again for more active fiscal policy.

The ECB’s updated economic forecasts are expected to show little change, with GDP growth and CPI inflation previously forecast at 1.2% and 1.0%, respectively, for 2020. There will be particular focus on the 2021 CPI forecast, previously seen at 1.5%, and a new forecast for 2022.

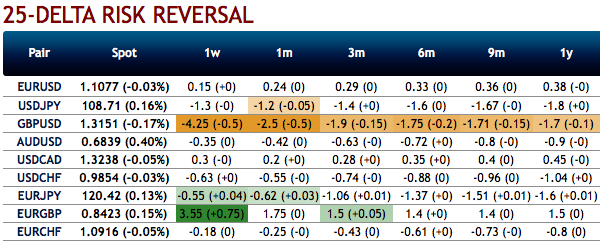

OTC outlook: The positively skewed IVs of 3m tenors are signifying the hedging interests for the bearish risks. The bids for OTM puts expect that the underlying spot FX likely to show further dips so that OTM instruments would expire in-the-money (bids up to 118.50 levels).

Most importantly, to substantiate the above indications, we could see some minor positive shifts in existing bearish risk reversal (RR) set-up of EURJPY that indicates the long-term hedging sentiments across all tenors are still substantiating bearish risks amid minor abrupt upswings in the short-term. Please be noted that 3m negative RRs suggest the overall OTC hedging sentiments for the further bearish risks. Hence, we advocate below hedging strategy contemplating the current OTC indications.

Options Strategy: Contemplating above factors, we’ve advocated buying 3m EURJPY (1%) ITM -0.79 delta puts for aggressive bears on hedging grounds as the mild abrupt upswings were contemplated earlier.

Short hedge: Alternatively, we advocated shorts in futures contracts of mid-month tenors with a view to arresting potential dips. since further price dips are foreseen we would like to uphold the same strategy by rolling over these contracts for January month deliveries ahead of ECB monetary policy. Source: Sentrix, Saxo & Commerzbank

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts