ECB is scheduled for their monetary policy this week, with the EURUSD continuing to stand above 1.11 ahead of Thursday’s ECB monetary policy meeting, the European central bank is all set to publish details on the allocation of its PEPP programme and focus will be on the potential skew towards Italian and French government bond holdings.

After a number of council members signalled steps of this nature - amongst them the ECB President Christine Lagarde, the market is now expecting the ECB to extent its current asset purchasing programme (PEPP) today. The amount which they would have to extent the programme by, which currently has a target volume of EUR 750bn. to surpass or disappoint market expectations. In the end we do not think that will be relevant for the euro anyway.

As long as sentiment on the market allows, it is going to continue its uptrend anyway. Of course a “hawkish” surprise, i.e. a less aggressive easing of monetary policy, might reinforce the trend briefly.

First of all it would confirm the market in its positive view of economic prospects and secondly many might see it as a sign that the ECB feels less obliged to fight the crisis now that the EU is planning on putting together a generous recovery fund.

What could put a break on the euro’s development though is the fact that much positive economic news has already been priced in - perhaps even too much. Even if the rise in sentiment indicators is no doubt positive this was to be expected after many countries eased their lockdown requirements so that companies could resume production and shops were allowed to open again.

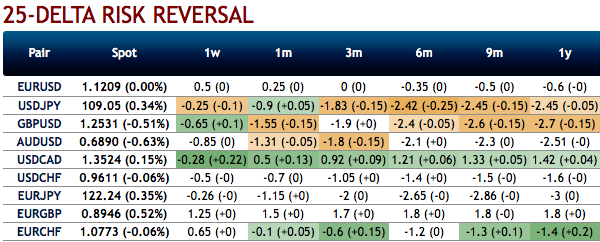

EURUSD risk reversals are trading positively again for tenors below 3-months, and at almost zero for 3-months (refer 1st chart). Because the dollar is less suited as a safe haven? Perhaps marginally. Above all because the market is considering the risk of a second wave of the pandemic to be low and considers a major, risk-driven slide in EURUSD to be less likely. Otherwise butterflies would not be virtually back at pre-corona levels. That might be sensible pricing levels for all those market participants who can spread their risks. Anyone not able to enjoy that luxury might be pleased about this good opportunity to hedge non-diversified risks against a renewed wave of risk aversion.

EUR risk reversals have still been indicating the hedging sentiments for the bearish risks in the long run, as the fresh negative bids are added to the positive RRs for 1-3m tenors.

Most importantly, the positively skewed EURUSD IVs of 3m tenors are stretched on either sides but with slight biasness towards downside hedging risks (refer 2nd chart), while IVs are shrunk below 6.5% across all the tenors.

Hence, considering all these factors, the below options strategies are advocated.

Options Strategy: Contemplating above factors, activated 1m butterfly spread on trading grounds. Initiated longs in 1m OTM -0.49 delta put while simultaneously shorting ATM put with similar expiries and buy 1m OTM 0.5 delta call while simultaneously shorting an ATM call with similar expiries. This strategy is structured for a larger probability of earning a smaller but certain profit as EURUSD is perceived to have a low volatility.Courtesy: Sentry, Saxo & Commerzbank

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action

BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis