The Japanese yen once again continues the appreciation trend seen over the past few days. The reason is a recent rise in speculation that the Bank of Japan (BoJ) might tighten its monetary policy this year. This speculation was further fuelled yesterday by the central bank’s announcement to be buying fewer long-dated government bonds as part of its asset purchasing programme in the future. Both yields and JPY went up significantly as a result.

Since inflation in Japan remains well under the envisaged target, the Bank of Japan (BoJ) is condemned to maintaining its ultra-expansionary monetary policy for the foreseeable future. The fact that the government is continuing with its Abenomics programme also points towards a continued expansionary monetary policy over the coming two years.

We, therefore, expect a weaker yen, in particular, if the US central bank Fed continues to hike interest rates as expected and the ECB slowly tapers its asset purchasing scheme

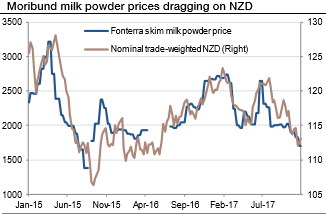

On the flips side, The Kiwi is expected to lose its pole position in terms of offering the highest central bank policy rate in G10 next year, and this should keep the currency a laggard. Moribund milk powder prices should also continue to drag on the currency (refer above graph).

There are therefore cross-currents buffeting the growth outlook next year, but the impact on 1H 2018 is likely to be the net negative. Inflation should consequently remain contained despite the 4.8% rise in minimum wages in April 2018. The government is also reviewing the RBNZ's mandate with the intention of inserting "maximum employment" as a second mandate alongside price stability and moving to a committee structure for monetary policymaking. The RBNZ is therefore expected to stay on the sidelines through 2018 in the face of the institutional changes and countervailing fiscal effects.

OTC Outlook and hedging strategies:

ATM IVs of NZDJPY is trading between 7.14% and 7.91% for 1w and 1m tenors respectively and positively skewed IVs of 1m tenors are evidencing bearish hedging interests. Bids for OTM puts upto 76.50 is noticeable to signify downside risks.

Thus, conservative hedgers can prefer the below strategy:

Debit Put Spread = Go long 1M ATM -0.49 delta Put + Short 1m (1%) OTM Put with lower Strike Price with net delta should be at -0.46. Please be noted that the positive payoff structure would be generated as it keeps dipping below current levels but remain within OT strikes.

For a net debit, bear put spread reduces the cost of trade by the premium collected (on the shorts of OTM put) and keeps option trader to participate in downward moves and any upswings in abrupt.

Moreover, the risk is capped to the extent of initial premium paid, as opposed to unlimited risk when short selling the underlying outright.

However, put options have a limited lifespan. If the underlying FX price does not move below the strike price before the option expiration date, the put option will expire worthless.

Currency Strength Index: FxWirePro's hourly NZD spot index is inching towards 18 levels (which is neutral), while hourly JPY spot index was at 115 (highly bullish) while articulating (at 11:41 GMT). For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit:

China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays