The driving forces of bearish risk reversals of USD:

1) Mounting skepticism that the Fed doesn’t tighten again in 2017 or allow the balance sheet run-off to begin

2) Chinese growth turns higher in Q3 and Q4, compared to consensus expectations of stability or modest slowing;

3) Non-US central banks turn increasingly hawkish into year-end.

The driving forces of bullish risk reversals of USD:

1) Congress gains momentum on tax reform and infrastructure (and maybe even the BAT).

2) China financial market tightening triggers fears of the spillover into broader growth, driving EM and Commodity FX weaker.

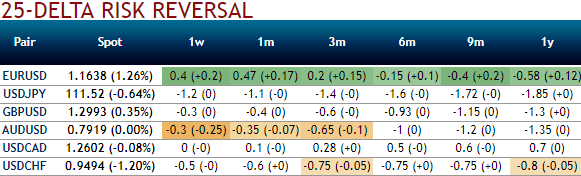

The risk-reversals of dollar crosses seem to be continuing to compress (USD calls to cheapen relative to USD puts). USD risk-reversals have under-delivered consistently through the past three years of trend dollar strength, and have been on a compression path in 2017.

The premium priced for USD calls over USD puts at the beginning of the year was not subsequently justified by the volatility of USD rallies as it became increasingly clear that the Trump administration favored a weaker greenback, leading markets to progressively de-price the likelihood of dollar-positive US fiscal and monetary policy impulses.

While AUDUSD major trend has been bearish and the risk reversals (RR) have been under mounting selling pressure, it has been the same sentiment since end-2013, driving them to the current cheap levels (the 3M RR is currently trading at only -0.65).

This week added another nail to the riskie coffin by adding out-performance of USD puts to go with the softness of USD calls i.e. compression pressure on USD-skews is now two-sided.

The inverse spot-vol correlation dynamic (weaker USD, higher vol) observed this week is likely to remain most pronounced in short- expiries that are the most sensitive to near-term spot gyrations, hence sub-3M skews are likely to tighten more aggressively than longer tenors; little surprise then that 1M skews have already flipped for USD puts in a number of pairs.

Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?