The decline of FX vol levels after the late July spike has continued steadily over the past few weeks, under the powerful influence of dovish major Central Banks quenching global recession fears, and as the market has started to price in an imminent US/China trade deal. In this context, FX short-Gamma strategies have delivered solid performances, with the benchmark portfolio we monitor of 1M 25delta strangle strategies up 9.7% so far in 2019. Our tactical filtering model, which has helped cutting the August drawdown at the expense of a slightly lower yearly performance (+8.0%), remains heavily biased towards short-Gamma, with the latest average signal at 89% of the max short-Gamma trade allowed.

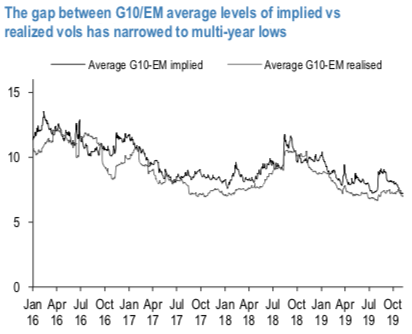

A natural benchmark for judging on the valuation of implied vol levels regards the level of realized volatilities; when averaging over liquid G10/EM USD pairs (refer 1st chart), the gap between the two, or vol premium, has narrowed to multi-year lows.

While the results of the earlier section can have a broader application beyond hedging towards directional trading with options. One of the main takeaways from the earlier piece favors trading forwards over low premium (spreads, seagulls, riskies) option constructs when the carry of the trade is positive, and options otherwise, at least in case of strategic trades where holding period is long enough for carry to materialize into actual PnL. Options are favoured when carry / vol is elevated, forwards otherwise. Forwards are again favoured from a PnL perspective when the underlying asset is expected to undergo large moves, as for instance indicated by a momentum indicator, whereas in the other cases options are preferred (although we stress that these conclusions could change if delta rather than notional matching was imposed as a pre-condition). The sign of the skew mostly helps breaking the impasse between riskies and spread structures, with positive riskies favouring call spreads and vice-versa.

As discussed, present market conditions are consistent with a low-vol market and with the generalized absence of major FX trends, beyond short-dated ones. Level of carry and pricing of riskies obviously depends on the currency pair and direction of interest (upside/downside). In the following we highlight a couple of case studies in case where one was interested in playing USD weakness over the next few months.

Let’s start considering the case where one wants to play a higher EURUSD over the next few months / year, but is mindful of the 260 yearly forward points associated with the trade. Reasoning above could favour low-cost upside option structures, especially if one believes repricing potential for EURUSD to be limited in the near term (EURUSD mid-2020 target from FX strategy team remains at 1.13).

The scorecard solution has allowed outperforming the benchmark forward trade over the past five years (refer above nutshells 2nd & 3rd chart). Recent flip in the sign of the skew favours call spreads over riskies for playing such a scenario. Call spreads are preferred over seagulls given that at present momentum indicator still points to EUR/downside risk, with 1m to 1Y moving averages all pointing to EUR weakness.

Consider: Buy 6m ATM/25-delta call spread on EURUSD at 83/88 EUR bp indic. Courtesy: JPM

2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge