The Australian federal government’s mid-year fiscal update is expected to show a deteriorating deficit as broad economic weakness offsets commodity price gains. Markets will be watching for any rating agency reactions. The Aussie crosses remain edgy, especially pairs like AUDNZD, AUDJPY well below fair value estimates implied by interest rates, commodity prices, and risk sentiment. However, Australia’s AAA downgrade risk is to be acknowledged, any such action likely to delay any return towards fair value during the next few month.

The rationale is that antipodeans currency crosses as “high yielding” avenues that suffer more as a result of the USD strength than most other G10 currencies.

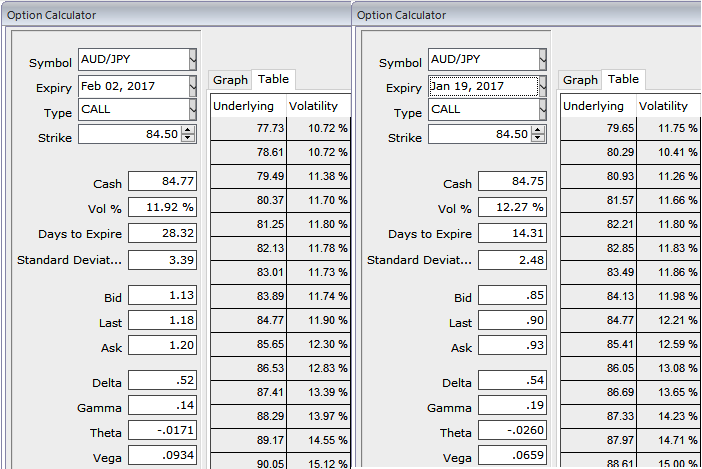

BoJ’s monetary is policy is scheduled for tomorrow, for this week, we think the pairs such as AUDJPY are blowing IVs crazily in OTC FX space that pops up with rising IVs above 12.27% for 2 week expiries and 11.92% for 1m tenors having significance in economic drivers that propels this currency pair to anywhere. We see no data announcement in both continents except Aussie trade balance and retail sales that are scheduled to be released this week and early next week respectively.

We retain our outlook for the BoJ to stand pat until at least mid-2017 when we expect the effects of fiscal stimulus to start fading. Next week’s focus will likely be on the post-MPM press conference and any comments BoJ Governor Kuroda may have about how yield curve control will be implemented amid rising yields.

We think the same HY IVs with longer tenors are conducive and justifiable for option holders as there are series of considerable economic events lined up going forward.

Well, in order to arrest this upside risk that is lingering in intermediate trend and prevailing declining trend, we recommend diagonal option strap versus OTM put strategy that favors underlying spot’s upside bias in long run and mitigates bearish risks in short term.

So, we recommend building the FX portfolio exposed to this pair with longs positions in 2 lots of 1M ATM 0.51 delta calls and 1 lot of ATM -0.49 delta puts of 2w expiries and 1 lot of (1.5%) OTM put of 1w expiry.

Since, the slumps are likely in near term and upswings in near term seem to be dubious as per the signals generated by technicals as well as from IV skews, AUDJPY option straps strategy should take care of both upswings and downswings simultaneously, even if the BoJ surprises with the forecasters, and the strategy is likely to derive handsome returns on the upside and certain yields regardless of swings on either side but with more potential on upside.

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan  Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios