Even though the end of the line is unlikely to have been reached in the Reserve Bank of Australia’s (RBA) rate cut cycle, the end is approaching. The Q3 inflation data, which was published this morning, confirms that. As for some time now it has been coming in at the lower end of the target range of 1-3%.

Moreover the labour market can do with even lower interest rates due to existing spare capacity, according to the RBA. On the other hand the RBA wants to keep its powder dry should negative external shocks threaten the economy. Moreover it is aware of the fact that its monetary policy is already quite expansionary and possible further cuts might have a smaller effect than was previously the case. And in the end it also sees the risk of low interest rates creating an asset price inflation.

As a result, it is likely to act cautiously in the future if it cuts its key rate further. We expect a further rate cut at year-end and that is likely to be it, in particular, as the trade conflict between the US and China has become significantly less tense so that the risk of a negative shock for the Australian economy has fallen. That means AUD is likely to be stabilized but that could be momentary. The major downtrend remains to be intact.

The Aussie has closed within a 0.6700-0.6900 range every day since late July. Iron ore prices are rolling over on patchy demand and resilient supply, while we believe the US and China still have major hurdles which will keep tariffs in place. Limiting downside though, we expect the RBA to hold steady into 2020.

The US Fed is scheduled for the monetary policy this week, it is a fait accompli for the market that the Fed will cut its key rate by 25bp to 1.50 - 1.75% today and that move is priced in.

OTC Outlook and Options Recommendation:

Contemplating above factors, we will now quickly run you through OTC outlook of AUDUSD, and advocate the options strategic framework that could keep AUDUSD exposures out of the woods.

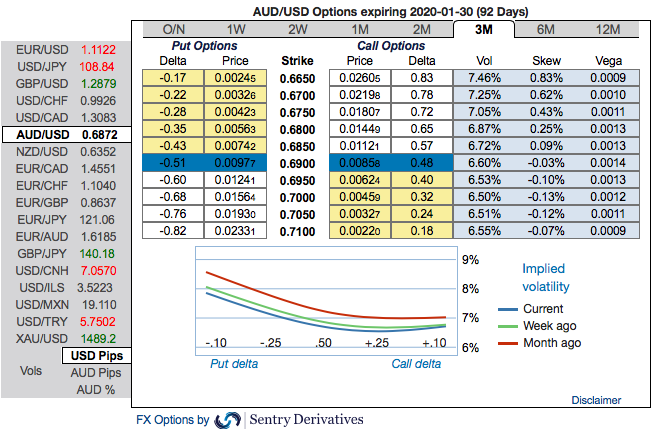

Please be noted that the positively skewed IVs of 3m tenors still signify the hedgers’ interests to bid OTM put strikes up to 0.6650 levels which is still in line with the above bearish projections (refer 1st nutshell).

Please also be noted that bearish risk reversals (RRs) across all the longer tenors are also in sync with the bearish scenarios (refer 2nd (RR) nutshell).

In RR nutshell, AUD OTC hedgers’ sentiments substantiate that their risk mitigating activities for the downside risks has been clear amid minor shift in shorter tenor.

Accordingly, diagonal put spreads are advocated to mitigate the downside risks with a reduced cost of trading.

The execution of options strategy: Short 2w (1%) OTM put option with positive theta (position seems good even if the underlying spot goes either sideways or spikes mildly), simultaneously, add long in 2 lots of delta long in 3m (1%) ITM -0.79 delta put options.

The rationale: Bidding above 3m IV skews, we have advocated delta long puts for the long term on hedging grounds, comprising of more number of ITM long instruments and theta shorts with narrowed tenors for 1m lower IVs to optimize the strategy. Bearish outlook with rising volatility good for the option holder.

While put writers would be on upper hand on theta shorts in OTM put options that would go worthless on lower IVs as the underlying spot FX keeps rising. Thereby, the premiums received from this leg would be sure profit.

We keep reiterating that the deep in the money put option with a very strong delta will move in tandem with the underlying. Courtesy: Sentrix, Saxo & Commerzbank

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures