The CAD is soft, down modestly vs the USD while underperforming most of the G10 currencies as market participants focus on escalating diplomatic tensions between Canada and China.

USDCAD’s intraday patterns reflect the longer run stalemate and range constriction on the daily chart highlighted yesterday. April price action in funds has been well-contained within at 1.33/1.34 range effectively, with the low end of the range holding four tests and the upper reaches holding three probes so far. Trend strength signals had been tilting positively for the USD but are weakening towards neutral again.

The CAD’s standard drivers—crude oil prices (WTI) and yield spreads—are once again dominating following a period of uncorrelated movement through most of November. A reminder that the CAD also remains completely uncorrelated to the price of Western Canada Select.

The BoC will continue with its hiking cycle over the next two years, whereas the Fed will end its own cycle next year. Hence, we expect the CAD to appreciate.

Canada has scheduled for the trade balance data announcement this week, Canada’s merchandise trade deficit narrowed to CAD 4.25 billion in January 2019 from an upwardly revised all-time high CAD 4.82 billion in the previous month and compared with market expectations of a CAD 3.5 billion shortfalls. It was the second largest trade gap on record. Exports rose 2.9 percent, the first increase since July, mainly on the strength of higher crude oil export prices and imports increased at a softer 1.5 percent, led by aircraft purchases.

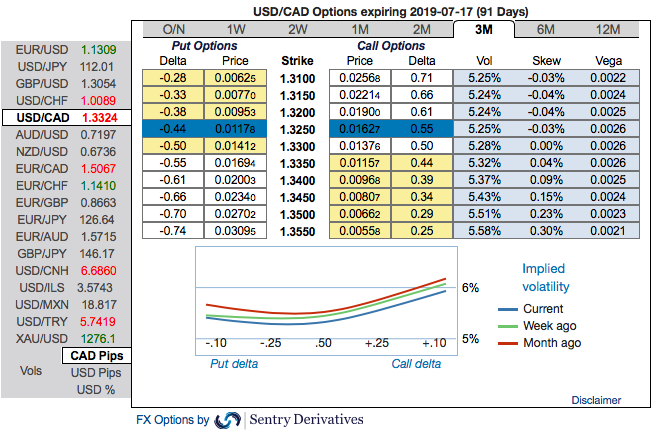

Options strategies: USDCAD call spreads with diagonal tenors are preferred option structures as an ideal hedging vehicle given elevated skew and favorable cost reduction.

At spot reference: 1.3324 levels, we execute USDCAD 3m/1m call spread with strikes of 1.36/1.32 for a net debit.

Rationale: Let’s quickly run through OTC indications to understand the FX hedging sentiments. 3M ATM IVs are trading a shy above 5.25% - 5.58%, positively skewed implied volatility is also indicating hedgers’ sentiments for upside risks as the odds on OTM call strikes up to 1.3550 levels, at this juncture, are prevalent. We could also notice bullish neutral risk reversals that signal upside risks in the risk-neutral distribution of returns. Also, the IV curve is at, or slightly decreasing, with maturity.

Favor optionality to directional trades. We are inclined to position for a directional call spreads, as calling the bottom is quite difficult and adding naked spot exposure is risky at the moment.

Maintain the net delta of the position above 40% and shorting the upper leg call (OTM strikes) likely to reduce the cost of the ITM call by almost close to 20-25%.

Maximum gain is achievable when underlying spot FX move above OTM strike with ideal risk-reward.

By shorting the out-of-the-money call, the options trader finances the cost of establishing the bullish position but forgoes the chance of making a large profit in the event that the underlying asset price skyrockets. Source: Sentrix & Saxobank

Currency Strength Index: FxWirePro's hourly CAD spot index is flashing at 106 levels (which is bullish), hourly USD spot index was at 11 (mildly bullish) while articulating at (11:23 GMT).

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data