The Bank of England will provide its first policy decision and Inflation Report for the year in a short while. That will be followed by BoE Governor Carney’s first press conference of 2019.

The market’s expectations for UK interest rate hikes have already been pared back in response to recent weaker UK and international economic data. Consequently, while the BoE will likely acknowledge increased ‘headwinds’ to economic growth it will probably want to avoid endorsing an even more ‘dovish’ path for rates. Most of the GBP crosses have been edgy ahead of this event with mounting volatilities.

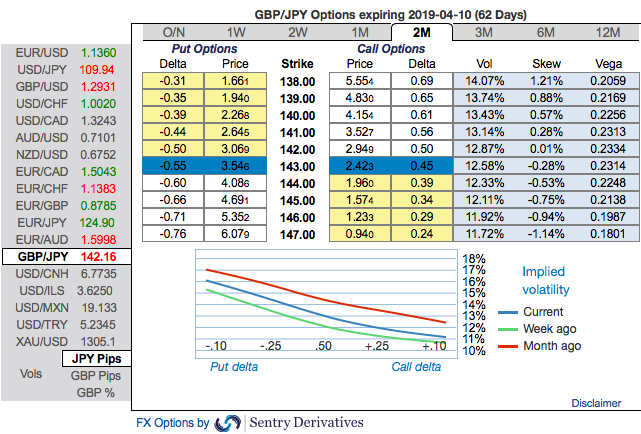

Please be noted that IVs of GBPJPY display the highest number among entire G10 FX universe (trending between 13.21% - 10.99%). Hence, vega long put is most likely to perform decently capitalizing on the rising mode of IVs.

While the positively skewed IVs of 2m tenors signify the hedgers’ interests to bid OTM put strikes up to 138 levels (refer above nutshells evidencing IV skews).

Accordingly, diagonal put ratio back spreads (PRBS) are advocated on the hedging grounds. Both the speculators and hedgers who are interested in bearish risks are advised to capitalize on abrupt and momentary price rallies, simultaneously, bidding theta shorts in short run, on the flip side, 2m skews to optimally utilize vega longs.

The execution: Capitalizing on any minor upswings, we advocate shorting 2w (1%) OTM put option (position seems good even if the underlying spot goes either sideways or spikes mildly), simultaneously, go long in 2 lots of long in 2m ATM -0.49 vega put options.

The rationale for PRBS: Well, the traders tend to perceive these trades as a bear strategy, because it deploys more puts. But actually, it is a volatility strategy.

Hence, entering the position when implied volatility is high and anticipating for the inevitable adjustment is a wise thing, regardless of the direction of price movement. Based on volatility and time decay, the strategy is a “price neutral” approach to options and one that makes a lot of sense.

Given the condition that IVs keep rising and if GBPJPY spot keeps dipping, then the vega longs would add handsome option’s premiums to the price of such puts correspondingly, these derivatives instruments target further bearishness of this pair. Courtesy: Sentrix

Currency Strength Index: FxWirePro's hourly GBP spot index is flashing -79 (which is bearish), while hourly JPY spot index was at 123 (bullish) while articulating (at 08:56 GMT).

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?