USDCAD retains a softer technical undertone but dollar losses have slowed through the latter part of the week as the market digests the sharp decline in spot seen on Monday, while the major uptrend appears to be still robust.

The underlying ‘risk-on’ phase that re-established around mid-March remains intact, with pullbacks remaining corrective in nature. The USD in particular remains under pressure, with support coming from the curve steepening as US 10- and 30-year yields push higher.

The key focus today will be on the May US labour market report. Last month’s figures showed nonfarm payrolls plunging by 20.5 million and the unemployment rate jumping up to 14.7%. A further deterioration in the labour market is expected for May, although as highlighted by the ADP and weekly jobless claims releases, it should be less severe than April.

Risk sentiment remained mixed during the Asia trading session ahead of today’s key US labour market figures. Brent crude oil edged above $40pbl as OPEC+, including Saudi Arabia and Russia, may reportedly meet as soon as this weekend to finalise an agreement to extend production cuts.

USDCAD softened overnight, reaching a marginal new low for the move down before recovering somewhat; the CAD continues to lag its G10 commodity peers even though the components for strength—firmer stocks and higher crude oil prices—are very much in evidence this morning. Moreover, yesterday’s comments from BoC DG Gravelle reaffirmed the more constructive tone of the Wednesday policy statement from the central bank; Gravelle noted that financial markets were more orderly, there were signs of improving economic and consumer confidence, and there were grounds for hope that the economy would avoid the worst-case scenarios around the pandemic. Gravelle repeated that policy makers were not in favour of cutting the O/N target rate below 0.25% but that policy makers were willing to provide more support for the economy if needed. Messaging is consistent through the late-Poloz and early-Macklem BoC eras, it would seem. Canada’s employment report is expected to show a decline of 500k for last month (Scotia at –1mn) and the unemployment rate rising to 15%. The CAD’s reaction to this morning’s data round is, however, more likely to be calibrated to how stocks react to the US NFP data (the CAD’s 22-day correlation with the S&P 500 has softened a little this week but remains meaningful at +62%).

USDCAD OTC Outlook And Options Strategy:

Given the above concerns, despite the move lower in USDCAD this week, we maintain that directionality from here is higher in the pair. It makes sense that CAD has focus on Canada's specific weaknesses grows larger.

Hence, add longs in USDCAD via options with diagonal tenors contemplating above fundamental factors and below OTC indications:

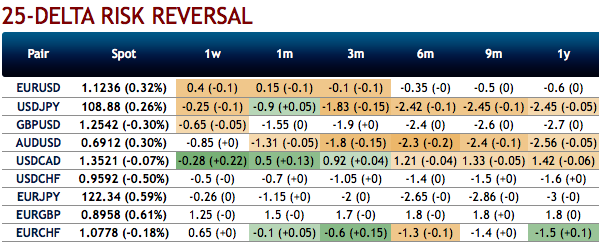

The fresh negative bids to the existing bullish neutral risk reversal setup indicates the broader hedging sentiments for the upside price risks amid minor hiccups in the shorter tenors (refer 1st chart).

To substantiate this stance, we combine the positively skewed IVs of 2m/2w tenors that are indicating the upside risks in in the longer tenors as well as downside risks in the shorter tenors (refer 2nd & 3rd charts).

Chart 2

Chart 3

Hence, at this juncture (spot reference: 1.3481 levels), we upheld our shorts in CAD on hedging grounds via 2m/2w (1.3815/1.40) debit call spread. If the scenario outlined above unfolds, we will re-assess our stance but at the moment there are no changes to our CAD recommendations. Courtesy: Sentry, Saxo & JPM

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges