As Sterling appears to be turbulent in the weeks to come, we run you through Commerzbank's hedging perspectives of Brexit risks in this write-up. Yesterday, PM Theresa May once again lost a vote on her Brexit strategy. The important thing is that she does not have a parliament at her back. She has messed up. Yes, it seems that time to take a cautious approach at potential FX developments in a no-deal scenario. Things are getting difficult indeed.

A “no-deal” scenario may become reality if those who really do not want a deal and those who may want a deal, but cannot accept a compromise which Brussels can stomach as well, join forces against those who would ratify a feasible compromise. And the risks have increased because May herself has long ago abandoned the only strategy which might be palatable to Brussels and is now veering between cozying up to the Brexit hardliners and appeasing the moderates – only to lose backing from both sides in the process. This may result in an outcome which only a minority of the MPs supports. A good example of applied game theory, but unfortunately not a good outlook for sterling.

Hedging the Brexit risk is difficult. Once it is clear that we will see a “no deal” outcome, sterling could depreciate considerably. Those who believe they can wait and act at the last moment will run into problems for two reasons. 1) There are probably many market participants who think so. This may lead to messy results. 2) Sterling may recover again once it becomes clear that the transition provisions take effect and that the UK does not sink into the ocean. This may result in major losses. The alternative is hedge via by buying optionality.

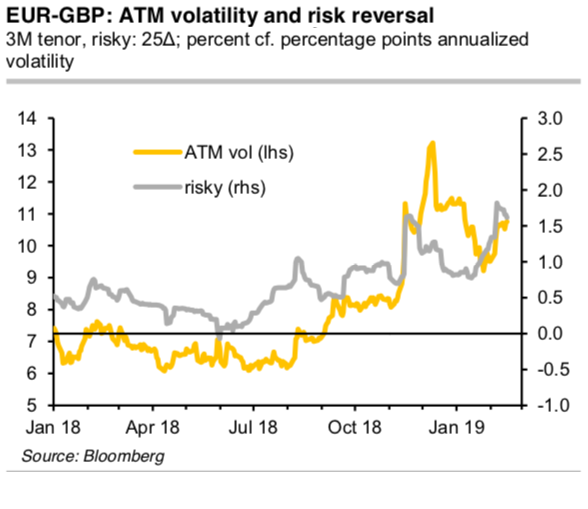

However, this strategy has recently become considerably more expensive (Refer above chart). Still, the GBP vol surface has not always accurately reflected the changing probability of a “no-deal” scenario. EURGBP optionality is expensive (particularly on the upper side) in comparison to summer 2018, but, from my vantage point, cheap in comparison to the no-deal risk. Courtesy: Commerzbank & Bloomberg

Currency Strength Index: FxWirePro's hourly GBP spot index is flashing at -113 levels (which is bearish), hourly EUR is at -97 (bearish), while articulating at (13:48 GMT).

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?