Daily Commodity Tracker (12:00 GMT)

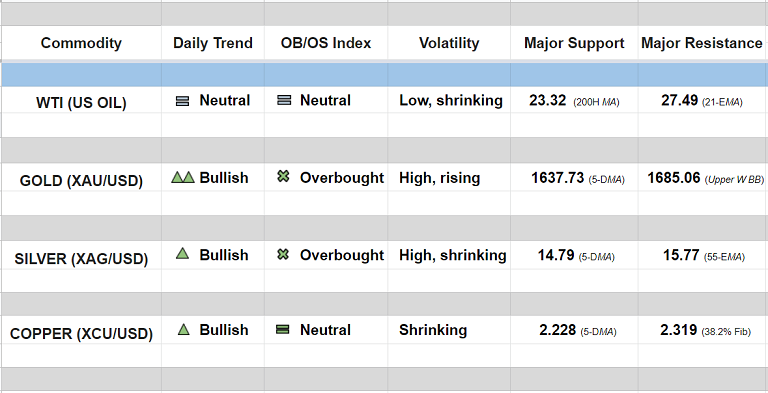

WTI (US OIL):

Major trend - Strongly bearish; Minor trend - Neutral

Oscillators: Neutral (bias higher)

Bollinger Bands: Shrinking on the daily charts, Widening on Weekly and Monthly charts

Intraday High/Low: 25.27/ 24.12

GOLD (XAU/USD):

Major trend - Turning slightly bullish; Minor trend - Bullish

Oscillators: At overbought

Bollinger Bands: Volatility remains high, rising

Intraday High/Low: 1655.536/ 1641.474

SILVER (XAG/USD):

Major trend - Turning neutral; Minor trend - Bullish

Oscillators: At overbought

Bollinger Bands: Shrinking on Daily charts, Widening on Weekly and Monthly charts

Intraday High/Low: 15.14/ 14.86

COPPER (XCU/USD):

Major trend - Strongly bearish; Minor trend - Bullish

Oscillators: Neutral (Bias higher)

Bollinger Bands: Shrinking on Daily charts, Widening on Weekly and Monthly charts

Intraday High/Low: 2.286/ 2.241

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One