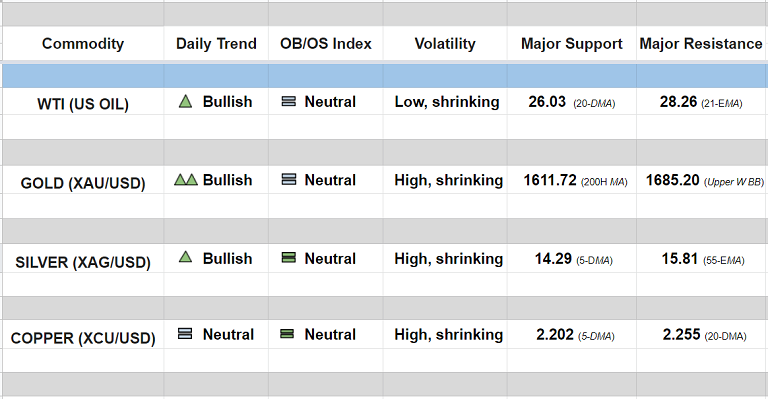

Daily Commodity Tracker (13.30 GMT)

WTI (US OIL):

Major trend - Strongly bearish; Minor trend - Turning bullish

Oscillators: Rollover from Oversold (bias higher)

Bollinger Bands: Widening on Weekly and Monthly charts

Intraday High/Low: 28.79/ 26.46

GOLD (XAU/USD):

Major trend - Turning slightly bullish; Minor trend - Bullish

Oscillators: Neutral (Approaching overbought)

Bollinger Bands: Shrinking on the daily charts, volatility remains high

Intraday High/Low: 1645.022/ 1609.260

SILVER (XAG/USD):

Major trend - Strongly bearish; Minor trend - Turning bullish

Oscillators: Neutral (Approaching overbought)

Bollinger Bands: Shrinking on Daily charts, Widening on Weekly and Monthly charts

Intraday High/Low: 14.67/ 14.24

COPPER (XCU/USD):

Major trend - Strongly bearish; Minor trend - Neutral

Oscillators: Neutral (Bias higher)

Bollinger Bands: Shrinking on Daily charts, Widening on Weekly and Monthly charts

Intraday High/Low: 2.225/ 2.179

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close