The actual make-up of US-China currency pact is a moot point for CNY FX sentiment in some perspectives, particularly in the short term. The fact that both sides have agreed to such a pact in the first place is a positive and will be seen by the market as a thawing in trade tensions. This point would be reinforced if such a pact were announced as part of partial trade deal that included China raising purchases of US agricultural goods and the US postponing planned tariff hikes for October and December of this year. Such a scenario could see USDCNH test the 7.00 level. Indeed it may be the intent of the authorities to manage the currency towards, if not below, this level, as a sign to de-escalate tensions.

After the initial kneejerk reaction from the market, this would likely be followed a period of stability in USDCNY. To the extent that trade negotiations become more closely aligned with USDCNY, the incentive for the China authorities to stabilize the currency could be quite strong. It’s important to note that this has been a feature before in terms trade negotiations and played a role in stabilizing USDCNY sentiment in August of last year. A stable CNY may be necessary for negotiations to continue and to limit the threat of additional/higher tariffs being put in place.

It appears that the trade optimism dominates the FX market sentiment for now, with USDCNY dipping below 7.10 later last week despite of weak Chinese data. Chinese vice Premier Liu He commented last Friday that the trade talks have been making "substantial" progress in many aspects, which had raised the hope that a "phase one" deal could be signed during APEC Chile summit. Certainly, few market participants think that any fundamental resolution between China and the US is possible. That said, any trade optimism will be likely short-lived but would certainly bring in more volatility.

On a separate note, China's new house prices slowed again in September, reflecting a generally tightening property policy. A property slowdown is certainly another piece of bad news for the growth outlook.

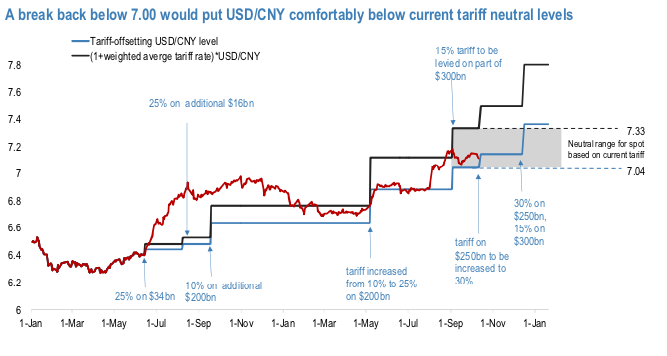

China is acceptable of a stable CNY only up to a certain point. Flexibility in the exchange rate is needed to ensure monetary policy independence and a weaker exchange rate over the medium term may still be needed to ensure China’s transition to a lower economic growth rate is a sustainable one. Importantly, a break below 7.00 would put USDCNY comfortably below the tariff neutral level (refer 1st exhibit). This is also an important difference between conditions now and those that prevailed in 2018. At that time, USDCNY was trading above tariff neutral levels. Hence it was easier to justify a rebound in CNY after the trade truce at the beginning of December. The other key difference is that cyclical conditions are decidedly weaker now compared to the end 2018 period.

Trade Strategy: At this juncture, we remain short in CNH via 6-month (7.15/7.35) debit call spread. If the scenario outlined above unfolds, we will re-assess our stance but at the moment there are no changes to our CNH recommendations. The positively skewed IVs of 3m tenors indicate that the upside risks of USDCNH are foreseen (refer 2nd exhibit). Courtesy: Sentrix & JPM

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand