Japanese Yen appreciated considerably in February 2016. This was attributable to rising concerns about the US economy and the credit risk of European financial institutions, as well as a sizable fall in oil prices which resulted in a global equity sell-off in January.

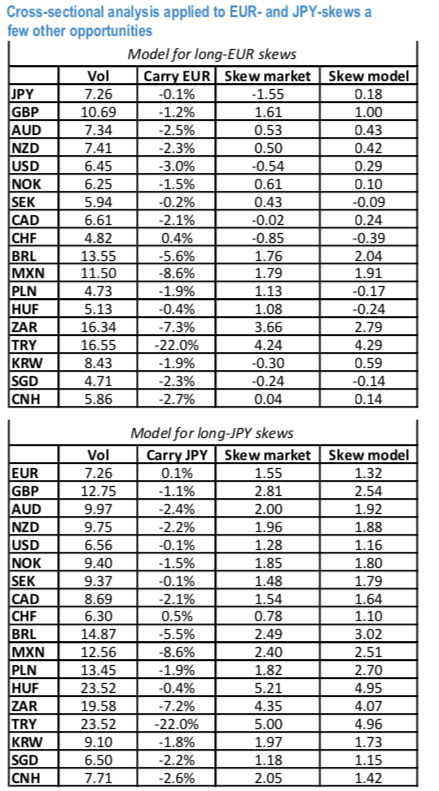

We run you through the cross-sectional analysis by contemplating EUR and JPY as the base currencies (refer above nutshell). The R2 of the 2-d regression analysis on the EUR has associated a lower R2 (75%) than for USD and JPY (above 85%).

As for the USD analysis, there appears to be room for buying EUR- and JPY-skews against Latam currencies, especially BRL. The analysis for EUR-crosses confirms the earlier result that EUR calls offer excellent value for hedging a drop of the USD.

We can now summarize how the earlier results could be used in practice. For trading purposes, one would naturally look to enter skew trades which offer a) a positive dislocation potential, and b) a natural risk-off exposure.

Having incorporated the carry component embedded in risk-reversals, the dislocation analysis should permit highlighting pairs where delta-hedged skew constructs are attractive from a Carry standpoint. Adding the further constraint of risk-off sensitivity allows selecting long-convexity trades where the cost of Carry is not punitive.

The long EUR-skew vs CNH (EM vol has peaked for now) would naturally fall within this category: here the 2.7% per year carry would call a higher level of implied skew than what is currently priced by the market. A few other opportunities that stand out from this perspective could be the cheap AUD and NZD riskies against the USD or the cheap SEK risk-reversal against the JPY. Based on this measure, when taking into account the contribution of carry and volatility TRY risk-reversals generally screen as fairly valued. Courtesy: JPM

Currency Strength Index: FxWirePro's hourly EUR spot index is flashing at 35 levels (which is mildly bullish), while hourly JPY spot index was at -85 (bearish) while articulating at 08:16 GMT.

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays