The CBR remains s dovish. We expect the measured pace of rate cuts beginning in June. May CPI at 4.1% oya surprised on the upside and is marginally above the inflation target of 4.0%. As our base case, JPM forecasts the CBR to begin its measured rate cuts beginning in June by 25bp with a chance of 50bp rate cut. By the end of 2017, we expect the policy rate to fall to 8.5% from 9.25% currently. We think there is also a possibility that the CBR may accumulate FX reserves on its own account should RUB remain over-valued in their view.

We turn bearish in RUB on concern of commodity headwind and seasonally weaker current account outlook over the summer. We are more cautious of the commodity exporter, as terms of trade are unlikely to be favorable for RUB as oil prices remain weak. Together with any potential return of generalized financial market volatility in the coming months, the effect will manifest itself in heightened volatility of RUB. We recommend buying RUB vol via USDRUB call options. Directionally, we think RUB is vulnerable to weakening over the summer as the current account seasonally deteriorates.

We are UW RUB and hold long USDRUB 6m call options (entry ref: 57.00, strike 59.00). We turned bearish RUB positions on 8 June, on the view that faltering oil prices, brewing geopolitical tension and a relatively dovish central bank would limit the potential for RUB appreciation, making the currency overvalued given its resilience so far this year.

Trading Options:

We advocate buying 3m USDRUB call strike 59, Sell call strike 62 knock-in 65 Indicative offer: 1.23% (vs 0.8% for the vanilla call spread, spot ref: 58.9502)

The position entails buying a USDRUB 3m call strike 59 financed by a call strike 62, with a topside knock-in at 65 only on this short leg. This structure offers potential extra gains compared to the vanilla call spread capped at 62, as the pay-off captures upside up to 65. In the event of a move beyond this barrier, the maximum gain is the same as for a vanilla call spread. Our appearing call spread costs only 17bp more than a vanilla proposal, but it potentially hedges twice as much RUB downside (about 10% instead of 5%), providing additional exposure at minimal cost.

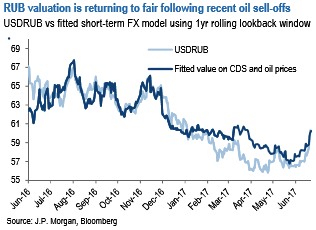

However, the sell-offs in oil in June and the corresponding RUB weakness has closed most of the valuation gap (refer above chart).

We, therefore, believe that going forward, the risks to RUB are less negatively skewed than earlier envisioned in the month. However, given the upside to oil prices remains capped, and given Russia’s current account remains seasonally weak in the summer, we think there are still good reasons to remain bearish in RUB against bullish in EM FX elsewhere.

Beware a RUB correction Are you concerned that RUB positioning is too heavy, stagnant price action is a warning sign, fundamentals could turn, and a significant correction could happen? We are. On 31 May, we recommended going long USDRUB as the ruble had approached the tipping point, looking for a move to 61.30 in the next three months, based on domestic factors.

We have a constructive view on EM assets, and our portfolio of trade recommendations is long FX carry trades (ZAR, MXN and TRY). However, our exposure has been selective, and we have shied away from short dollar risk in the BRL and RUB in recent months. Overall, being long USDRUB is a good hedge for a portfolio with high yielder exposure.

China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different