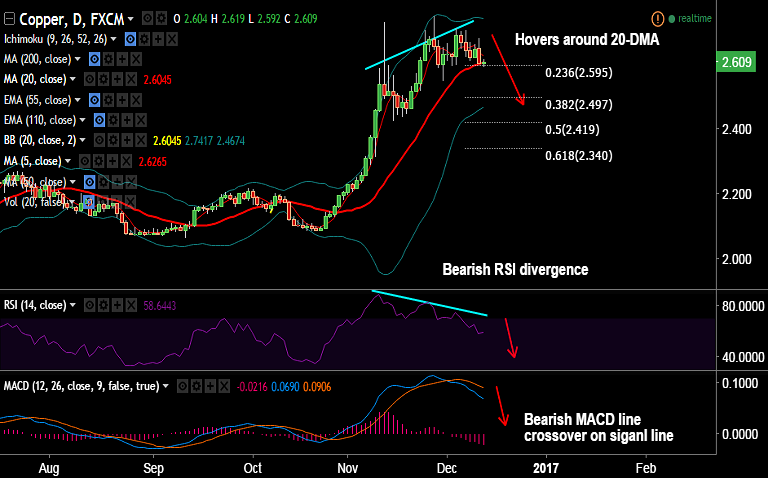

- Copper extends downside from 6-month highs of 0.752 hit on Nov 27.

- Bearish RSI divergence on daily charts supports further downside.

- Prices are hovering around 20-DMA at 2.605, close below on a daily basis will see further drag.

- 23.6% Fib at 2.595 is major support on the downside, break below finds next major support at 2.550 (Nov 30 low).

- Our previous call (http://www.econotimes.com/FxWirePro-Bearish-RSI-divergence-on-copper-charts-good-to-go-short-on-rallies-443058) has hit TP1&2.

- Technical studies are biased lower, we see bearish invalidation only above 0.70 levels.

Recommendation: Book partial profit at lows, hold for further downside.