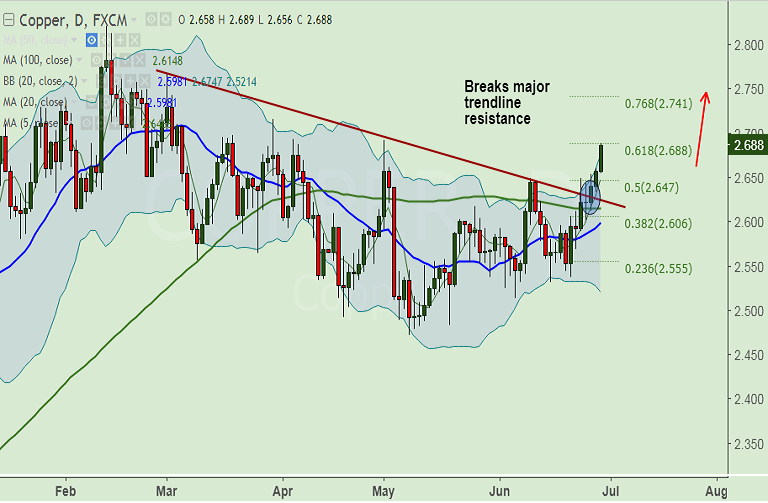

- Copper has edged lower from 3-month highs at 2.714 and is currently trading at 2.685.

- We see upside to remain intact as long as 5-DMA support at 2.6586 holds.

- RSI strong at 61, biased higher. MACD support uptrend. Stochs at overbought could see some correction.

- Major weakness only below 100-DMA at 2.6138, violation there could see test of 23.6% Fib at 2.555.

Support levels - 2.6584 (5-DMA), 2.6547 (50% Fib of 2.822to 2.472 fall), 2.6138 (100-DMA), 2.606 (38.2% Fib)

Resistance levels - 2.716 (Mar 30 high), 2.747 (78.6% Fib), 2.767 (Mar 1 high)

Call update: Our previous call (http://www.econotimes.com/FxWirePro-Copper-hovers-around-618-Fib-at-2688-bias-higher-stay-long-781280) has hit TP1&2.

Recommendation: Book partial profits at highs, raise trailing stop to 2.680, hold for 2.745

FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest