- Copper extends bull-run for 5th successive session, bias higher.

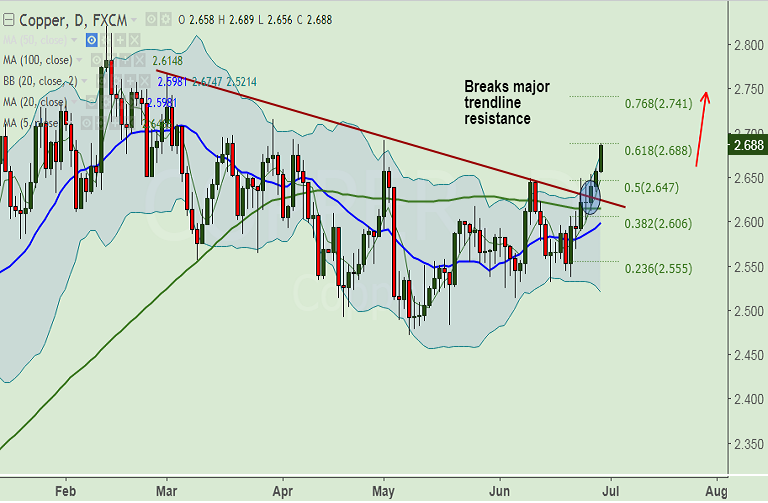

- Price action has broken major trendline resistance at 2.620.

- Upside struggling to extends above 61.8% Fib of 2.822 to 2.472 fall at 2.688.

- Technical indicators are biased higher, break above 61.8% Fib see next major resistance at 78.6% Fib at 2.747.

- RSI strong at 61, biased higher. MACD support uptrend. Stochs at overbought could see some correction.

- Weakness only below 100-DMA at 2.6148, violation there could see test of 23.6% Fib at 2.555.

Support levels - 2.647 (converged 5-DMA and 50% Fib), 2.6148 (100-DMA), 2.606 (38.2% Fib)

Resistance levels - 2.716 (Mar 30 high), 2.747 (78.6% Fib), 2.767 (Mar 1 high)

Recommendation: Good to go long on dips around 2.680, SL: 2.645, TP: 2.70/ 2.715/ 2.745

FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest