The Canadian economic position seems encouraging, with GDP and retail sales both producing upbeat consensus expectations in March.

Despite the prevailing economic conditions, the BoC stood pat at its current policy stance at April’s meeting as well.

BoC's overnight rates remained unchanged at 0.50% with Governor Poloz’s likely to maintain an optimistic tone.

In contrast, RBA brought in rate cut change in its monetary policy, now overnight cash rates are flashing at 1.75%.

The RBA cut the cash rate by 25bps yesterday to combat low inflation, and is likely to follow up with another rate cut in the near term, although we will firm up our expectation of the timing after Friday’s Statement on Monetary Policy.

With yesterday’s rate cut and hovering rating agencies emphasising current economic fragilities, combined with a looming election and constrained finances, this year’s Budget was always going to be a difficult one.

While leveraged accounts remained bullish on commodity currencies, led by the AUD. They raised their net AUD longs by USD0.8bn to USD3.4bn, the highest since Sep 14.

OTC observation:

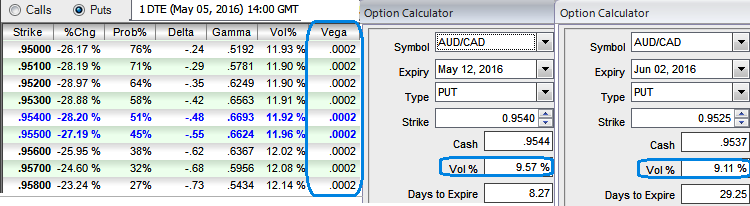

1W ATM IVs of AUDCAD contracts are stagnantly creeping up from current 9.57% to 9.11% of 1m tenors.

But, have a glance on Vega for OTM strikes, it’s been quite over different OTM strikes. When we observe these sensitivities of option’s various strikes to a change in volatility, what strikes our mind is that – more chances of spot FX curve to drift through southwards.

So what is causing this consistent Vega - Usually Vega is at its highest for ATM options and declines exponentially as the option shifts into ITM or OTM.

This is because a small change in IV will make no difference on the likelihood of an option far out-of-the-money expiring ITM or on the likelihood of an option far into-the-money not expiring ITM.

ATM options are far more sensitive since higher IVs greatly increase their chances of expiring ITM.

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty