Background:

In this FxWirePro Commodities Watch, we are to present to our readers, the performance of the various commodities, categorically classified, which are keys in understanding the broader global economy. For example, copper is considered as a barometer of global economic activity or gold is considered a safe haven.

We consider the commodities as a must watch due to their impact on inflation.

Hence, we present to our readers, the performance of commodities, which in turn decide the wellbeing of many commodity-producing nations. For example, Russia, Saudi Arabia, and Qatar benefit from a higher oil price. However, we are not restricting ourselves to industrial commodities but to agricultural ones too as they are vital for many economies. The higher price of cotton benefits India, while coffee and orange juice benefit Brazil.

While commodities have performed well since 2016, but in 2018, the effect of trade wars is having a major impact and clouding the outlook.

Biggest Producers:

- Lumber – China, Canada, Germany, and the United States

- Orange Juice – Brazil, United States, Mexico, and India

- Cocoa – Ivory Coast

- Coffee – India, Pakistan, China, and the United States

- Cotton – China, India, and the United States

- Sugar – Indian, Brazil

Biggest Consumers:

- Lumber – United States

- Orange Juice – United States, Germany, and France

- Cocoa – Ireland, United States, United Kingdom, and Austria

- Coffee – Finland, Norway, Iceland, and Denmark

- Cotton – Bangladesh, China, and Vietnam

- Sugar – United States, Germany, India

This group has performed extremely well in 2016. For example, Sugar price rose more than 50 percent in 2016. And thanks to higher agricultural prices, global food index turned positive for the year 2016. However, 2017 has not been that well.

In this article, we evaluate the YTD performance of soft commodities, which are agricultural. The performance has been mute compared to 2016. Can 2018 be any better?

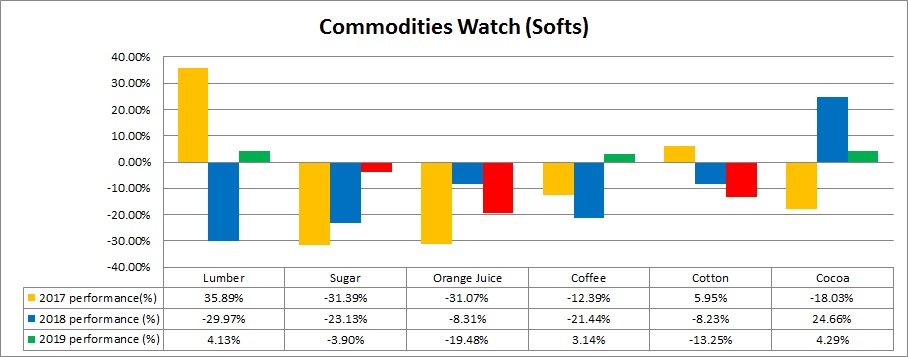

2017 Performance:

- The best performer in this pack has been Lumber (35.9 percent). US-Canada lumber dispute could lead to a further increase in price. Cotton was up (+5.9 percent).

- The other members of the pack didn’t do so well in 2017, despite outperformance in 2016. Sugar was the worst performer with 31.4 percent loss, followed by Orange Juice (-31.1 percent), Cocoa (-18 percent), and Coffee (-12.4 percent).

2018 performance:

- In 2018, Cocoa was the best performer with 24.7 percent gain

- The worst performer of the pack was Lumber (-30 percent), followed by Sugar (-23.1 percent), Coffee (-21.4 percent), Orange juice (-8.3 percent), and Cotton (-8.2 percent).

As a whole, the Softs pack was down 11.1 percent in 2018.

2019 performance:

- In 2019, the pack has done really badly, largely due to trade uncertainties and higher supplies.

- The worst performer of the pack was Orange juice (-17.9 percent), followed by Cotton (-9.9 percent), and Coffee (-4.2 percent)

- The best performer of the pack is Lumber (+16.9 percent), followed by Sugar (+4.1 percent), and Cocoa (+2.7 percent).

As a whole, the Softs pack is down -1.4 percent in 2019. The pack is up 7.5 percent since our last review, a month ago.

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed