Understanding commodities are vital to gauge the performance of other asset classes such as bonds, equities, and even currencies. Since, 2014, any regular follower of financial markets would be able to recall that how devastating the drop in oil prices has been for many countries like Russia, Brazil, and Malaysia whereas net importer of oil like India has largely benefitted from it. Hence, it is of utmost importance to investors to keep a tab on the trends in the commodities market.

We, at FxWirePro, have been sensing a change in tide in the commodities market. After months and years of battering by traders and investors, this year, they are once again becoming the darlings. Many of the commodities have risen more than 20 percent this year and that figure in most cases will be much larger if we consider it from the bottoms, which were largely made earlier this year. A more than 20 percent rise from bottom technically indicates a change in the trend.

In this Commodities Watch, we present to our readers, the performance of commodities, which in turn decide the wellbeing of many commodity producing and consuming nations. For example, China is a major consumer of soybeans, so if the price goes higher, it may drag the country’s trade balance as it imports most of its consumption.

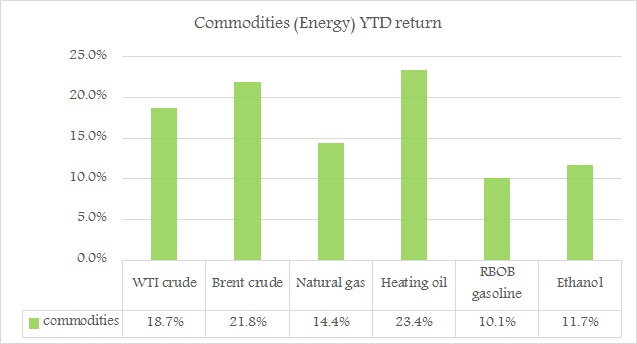

In this article, we evaluate the YTD performance of Energy segment.

- The best performer in this pack is heating oil (23.4 percent), followed by Brent crude (21.8 percent).

- WTI benchmark isn’t far behind with its 18.7 percent gains.

- Both Natural gas and Ethanol has risen more than 11 percent.

- The worst performer of the pack has been RBOB gasoline, which just rose little more than 10 percent. This is vital, as Crude price rises more than gasoline, refiners are going to have a tough time.

Energy as a pack gained 16.7 percent so far this year.