Long EURJPY is a strategic view on the sequencing of central bank policy. The ECB remains on the cusp of tapering, even if Draghi would not commit this week to a particular meeting for that decision to be taken, over and beyond flagging the autumn.

Meanwhile, the BoJ is resigned to waiting yet another year before it expects to achieve its 2% inflation objective, with its best guess now being that mission will not be accomplished until FY19. In recent weeks, the G10 (ex. Japan) long-end yields have risen sharply due to heightened speculation on policy normalization spurred by a series of hawkish commentaries from central bank officials.

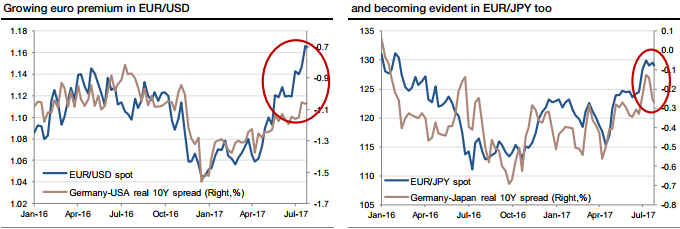

Real yield spreads in both EURUSD and USDJPY have supported a weaker dollar. That being said, it is becoming apparent that there is a growing euro premium, which can be seen even in the EURJPY cross in recent weeks (refer above charts). While the divergence in the thrust of policy seems clear enough and also relatively persistent, we'd acknowledge that EURJPY bulls are now in the majority and that crowded spec positions could slow the extension in the spot in the low 130s.

This set-up favors holding short gamma overlays to core long positions, for instance through ratio call spreads or, in our case, a call RKO.

Bought EURJPY at 128.50 on July 4th. Marked at 0.84%.

Bought a 2m EUR call/JPY put, strike of 133 RKO 137 for 21bps on July 7. Worth 12.5bp.

BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action

BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom