RBNZ’s monetary policy that is scheduled for Wednesday. The kiwis central bank cut 50 bps in its August meeting and had said that there was room to cut further "if required." We interpret this as an easing bias rather than a signal. In other words, the RBNZ views a cut as more likely than a hike, but is not committing to either at this point. We reckon that the prevailing rallies of NZDJPY are momentary, NZD is expected to depreciate towards 67 levels by year-end.

Although NZDJPY shows interim rallies upon hammer and dragonfly doji patterns 70.229 and 70.157 levels respectively, these upswings seem momentary as the overbought pressures The decline in January could extend below 70.00 if the coronavirus epidemic persists.

Event risk during this week comes from wage data and a leading index. Although we have a positive outlook for the NZ economy in 2020, the global risks are expected to persist.

Hence, it is wise to capitalize on interim rallies and optimize ‘debit put spreads’ ahead of the central bank’s policy event. Before we deep dive into the hedging framework, better to be aware of bearish driving forces of NZDJPY.

Bearish NZDJPY scenarios:

1) Tightening by banks forces a deeper slowdown in credit growth, and weakens the agricultural sector;

2) The immigration rolls over more quickly.

3) The global investors’ risk aversion heightens significantly;

4) Global economy enters serious recession; and middle-east tensions escalate sharply.

OTC Updates, Trade and Hedging Recommendations:

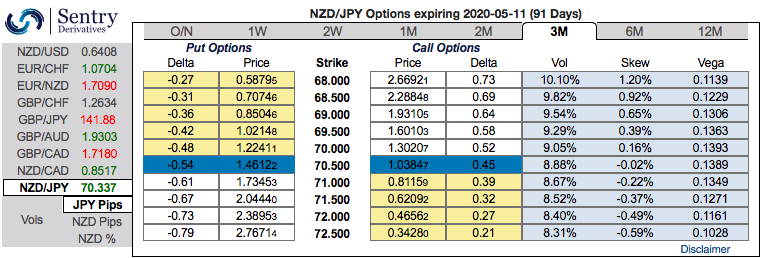

The positively skewed NZDJPY IVs of 3m tenors signify the downside risks, the bids for OTM put strikes up to 68 levels clearly indicates hedgers are inclined for further downside risks (refer above nutshells evidencing IV skews). The major downtrend continuation shouldn’t be panicked the broad-based bearish outlook amid minor rallies.

Hence, it is conducive for OTM put writers capitalizing on short-term rallies so as to reduce long-leg meant for downside hedging.

The execution of strategy goes this way: Initiate longs in at the money -0.49 delta put options of 3m tenors, simultaneously, short (1%) out of the money put options of the narrowed expiry (preferably 2w tenors), the strategy is executed at net debit (activated when spot reference: 70.957 levels).

Well, a higher (absolute) Delta value is desirable on long leg in the above stated strategy. Whereas, the Theta is positive on short leg; as the time decay is good for an option writer (that’s why we’ve chosen narrowed expiry). The short side likely to reduce cost of hedging with time decay advantage on short leg, while delta longs likely to arrest potential bearish risks.

Alternatively, shorts in the mid-month futures have been advocated with a view of arresting further downside risks. Courtesy: Sentry

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns

South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook