We maintain the bearish CAD standpoint in the medium-term, expressed as a one-touch calendar call spread. In particular, we have reservations about the smoothness of the USMCA ratification process, which is starting to show some signs of life in DC and is largely tracking our timeline and base case for now. Shorter-term drivers were in focus this week for CAD, though.

In particular, Canadian Q4 GDP disappointed across the board versus expectations (0.4% vs 1.0%), whereas US GDP outperformed (2.6% vs 2.2%), and is the lowest quarterly growth rate since 2016. Given the importance of the m/m figure (-0.1%) in BoC policy-making, this is likely to reinforce the wait-and-see pause for some time, even with the acknowledgment that the policy rate remains 75bps below the neutral range.

Meanwhile, CAD may yet come under pressure as political risk mounts surround PM Trudeau in the SNC scandal.

In addition to serious allegations against the PM and calls for him to resign, Canada is set to hold federal elections later this year.

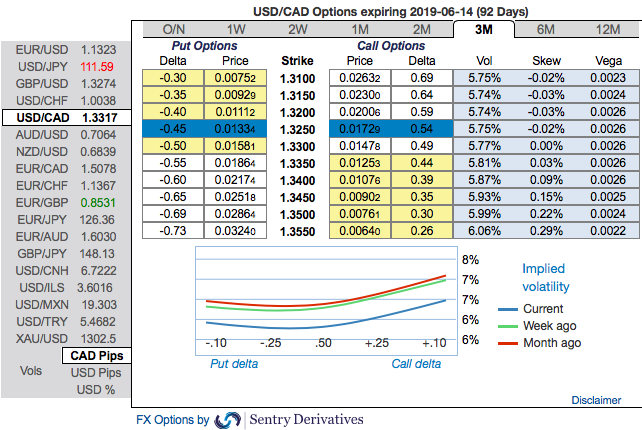

3M ATM IVs are trending a shy above 6.26% - 6.58%, skews are also suggesting the odds on OTM call strikes up to 1.36 levels at this juncture. We could also notice bullish neutral risk reversals that signal upside risks in the risk-neutral distribution of returns. Also, the IV curve is at, or slightly decreasing, with maturity.

Favor optionality to directional trades. We are inclined to position for a directional call spreads, as calling the bottom is quite difficult and adding naked spot exposure is risky at the moment.

The call spreads are preferred option structures given elevated skew and favorable cost reduction.

Hence, activated a -3m/+7m OT USDCAD calendar call spread (k=1.40). Paid 16.6% in January. Marked at 18.27%. Courtesy: Sentrix & JPM

Currency Strength Index: FxWirePro's hourly USD spot index is flashing at -25 (which is mildly bearish), CAD is at 146 (highly bullish) while articulating at (14:08 GMT).

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges