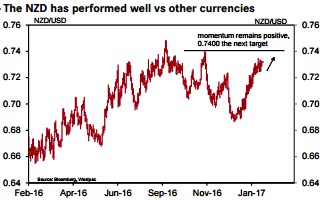

The sharp rise in NZDUSD during the past month continues to reflect the pullback in the US dollar as well as continuing strength in the NZ economy. The November high at 0.7400 is now vulnerable, and should that break then 0.7485 will be in sight (refer above chart).

This Thursday we have the RBNZ’s MPS. It should cause few ruffles in the market, with the policy stance (on-hold with a neutral bias) likely to be retained. That is because the positive impulse from dairy prices is roughly offset by the higher NZD TWI and higher funding costs. The RBNZ’s OCR projection should remain unchanged at 1.7%.

However if there is a risk of it shifting it would be in an upward direction. Should that occur, markets will feel emboldened to price in rate hikes even more aggressively than the 100% chance of one in November.

The RBNZ inflation expectations survey, just released, surprised markets with a healthy jump from 1.68% to 1.92%. At the margin, this could impart a slightly hawkish tone to Thursday’s press release.

The GDT dairy auction (Tonight) is predicted by futures to result in a 1.5% fall in WMP prices, which should be trivial if proven true (refer above chart).

Speculative positioning in NZDUSD, proxied by CFTC futures positions of leveraged and non-commercial trader types, indicates longs are starting to be rebuilt and are at the highest level since November (refer above chart).

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices