Despite strong manufacturing growth across most of the CEE, inflationary pressures are not emerging yet. Most of the headline CPI acceleration we have witnessed has been driven by large commodity price swings acting on top of a low base. Underlying core inflation dynamics remain stable.

This was once again highlighted by Czech import price data and Polish wage data yesterday. The latter has recorded 4%-plus year-on-year increase during all months this year, but as usual year-on-year growth numbers can include misleading base effects. Seasonally adjusted wages fell by 0.3% m/m in April after increasing by 1.5% in March.

In other words, April was a weak month for wage growth and this will likely impact household consumption. When extrapolating recent economic strength indefinitely into the future, this is precisely the kind of reversal the market should guard against.

We see NBP remaining dovish, and forecast EUR-PLN to reach 4.25 by the end of Q2.

One recent positive development is that compulsory FX mortgage conversion now seems unlikely.

Zloty support from interest rates is limited from current levels, with the market pricing rate hikes in line with JPMorgan's economists over the next 2 years.

Trading tips:

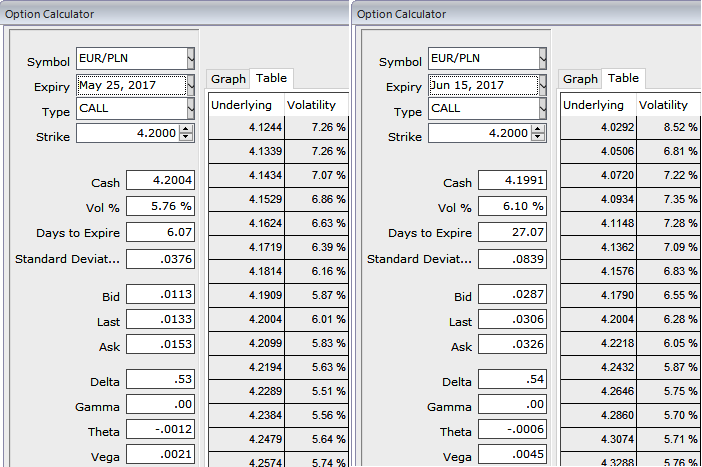

Please be noted that the ATM IVs of EURPLN is at shy above 5.75% and at 6.10% for 1w and 1m tenors respectively.

At spot ref: 4.2024, we advocate entering a new EURPLN 1m2m diagonal call spread (4.2235/4.1518). The underlying spot FX trend and IVs are favorable to write ITM calls.

Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close