FX volatility is easing off following the March Fed hike and the reduction in political risk, following the defeat of the populist candidate in the Netherlands and a wider bookmakers’ spread between Macron and Le Pen (refer above graph).

In our view, the FX euro vol market is complacent compared to the bond market, seeing the resilient 10y OAT-Bund spread. This relief offers an attractive entry point to hedge a large euro downside move via options.

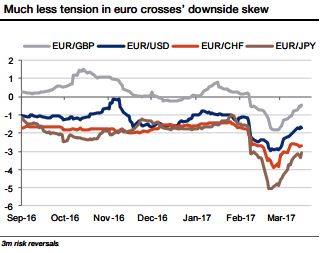

The 3m downside skew in euro crosses retraced sharply, and almost fell to last year levels in the EURUSD and EURGBP (see above graphs for risk reversals and vols).

The EURJPY and EURCHF skew are also materially less expensive, with, in particular, the EURJPY 3m risk reversal returning below -3 from -5. Indeed, the 3m ATM vol is not that high compared to the spot level, further suggesting designing a long vega hedge.

EURJPY implied volatility is already high compared to realized volatility but would spike much higher if the spot were to collapse (negative vol/spot correlation – see top chart). Indeed, the 3m ATM vol is not that high compared to the spot level, further suggesting designing a long vega hedge.

In addition, an effective hedge must not be conditional but delivers anyway if the feared market scenario becomes reality. Also, euro spot market liquidity is very likely to deteriorate sharply if Le Pen wins, prompting large intraday moves. In these conditions, the most appropriate strategy is buying a one-touch option: it takes advantage of the recent skew cheapening, would highly benefit from a rise in downside vol and is the best way to catch a short-lived bottom in the spot.

Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand