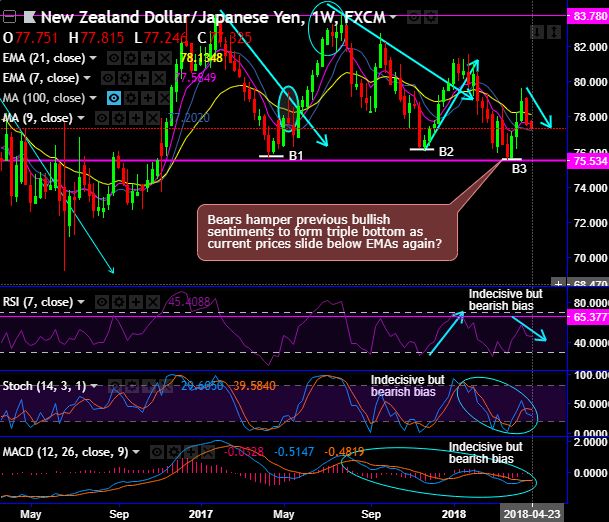

NZDJPY’s recent peak is the latest in a series of lower peaks during the past year (refer above chart). The intermediary trend has been oscillating between 83.780 and 75.534 levels, but the recent decline has potential to push below 76. There’s no major Japanese data or event for markets to watch this week.

The medium-term perspectives: BoJ tightening may be a long way off, but that won’t stop markets from starting to price it in, supporting the yen and depressing the pair below 76 levels by the Q2 end.

Bearish NZDJPY scenarios:

1) The housing market slowdown becomes disorderly

2) The immigration rolls over quickly

3) NZ bank funding issues intensify, causing the market to question NZ's ability to attract capital inflow.

Bullish NZDJPY scenarios:

1) Fiscal easing is delivered quickly

2) New RBNZ Governor Orr starts with a surprisingly hawkish bent.

NZD faces headwinds, even in a clearly weak USD environment. Domestic growth has weakened, the central bank’s inflation forecasts have been revised materially lower, net immigration is slowing and business confidence has fallen significantly since the change of government. But with the central bank in a state of transition (new governor, new mandate), over the next couple of months, we don’t see any domestic monetary policy catalysts that would drive material NZD weakness in the near-term.

Just a week ago, we at FxWirePro have well anticipated the swings of NZDJPY, contemplating potential slumps, for now, options strips as a better hedging strategy is advised, the strategy contains 3 legs. Of which 2 lots of 2m at the money put options and 1 lot of at the money call option of similar expiration.

Contemplating both fundamental and technical trends of the underlying pair, to participate in the puzzling swings, we advocate option strips strategy that contains 3 legs of vega longs (2 puts plus 1 call). The option strips that likely to fetch desired yields regardless of the trend but more potential on southwards by arresting bearish risks.

As shown in the diagram, the execution goes this way: Initiate 2 lots of 1m longs in Vega put options, simultaneously, add 1 lot of Vega call options of the similar expiry, the strategy is executed at net debit.

One can deploy this strategy both on trading as well as hedging grounds. Please be noted that the strategy is likely to derive positive cash flows regardless of the underlying spot FX moves with more potential on the downside (please also be noted that the tenors shown in the diagram are just for demonstration purpose, use accurate tenors as per the requirements).

Currency Strength Index: FxWirePro's hourly NZD spot index is flashing at -113 levels (which is bearish), while hourly JPY spot index was at shy above -8 (neutral) while articulating (at 11:27 GMT). For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit:

China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation