AUDJPY major trend goes in consolidation phase but for now, has been losing its momentum as stated in our recent write up on technical section. For more reading, visit below weblink:

Since this early signals of weakness in this pair in conjunction with below fundamental driving forces, prompt us to advocate below option strategies on hedging grounds.

Now, let’s just glance through some fundamental key drivers,

Bearish scenarios:

1) The unemployment rate moves back towards 6%, forcing the RBA to respond more aggressively to weak inflation

2) China data weaken materially, evidently, we saw the recent Caixin China Services PMI unexpectedly declined to 50.6 in September of 2017 from 52.7 in August, way below market consensus of 53.1. The reading pointed to the weakest pace of expansion in the service sector since December 2015, as both new orders and employment rose at a slower pace and confidence softened. Also, the level of outstanding work at Chinese services companies declined during September, after a four-month sequence of accumulation. China has been major trade partner of Australia, thus, AUD can have an adverse impact on lackluster data prints from China.

Bullish scenarios:

1) China eases policy and commodities rebound

2) The RBA adopts a more hawkish tone to its communications.

So far, RBA outlook seems to be on hold for some time which is anchoring short-maturity interest rates and should keep 3yr swap rates in a 1.8% to 2.3% range, as long as core inflation remains below 2%.

While JP Morgan’s projections of AUDJPY at 81 by Dec’2017, 79 by Q1’2018.

Hedging framework (AUDJPY):

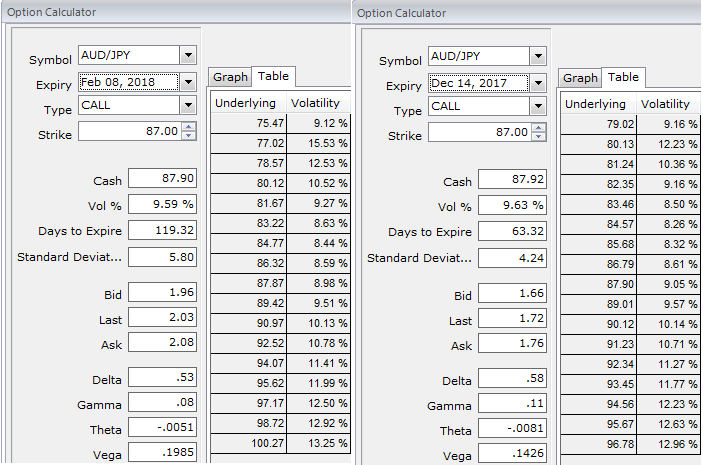

On hedging grounds, risk-averse traders, capitalizing ongoing rallies of the underlying spot FX, we advocate shorting a 3M in premium-rebate notional and buying a 6M 84.250 AUDJPY one-touch put.

At spot reference: 87.634, those who wish to reduce the cost of hedging; we advocate buying 4M sell 2M AUDJPY diagonal debit put spread at 90.159/86 strikes in 1:0.753 notionals.

Implied vols are on the higher side which is conducive for option holders, hence, we’ve chosen ITM striking put in the above strategy even though if underlying spot sees any abrupt spikes, it is likely to head southwards in the long run as we agree with JP Morgan’s projections.

Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data