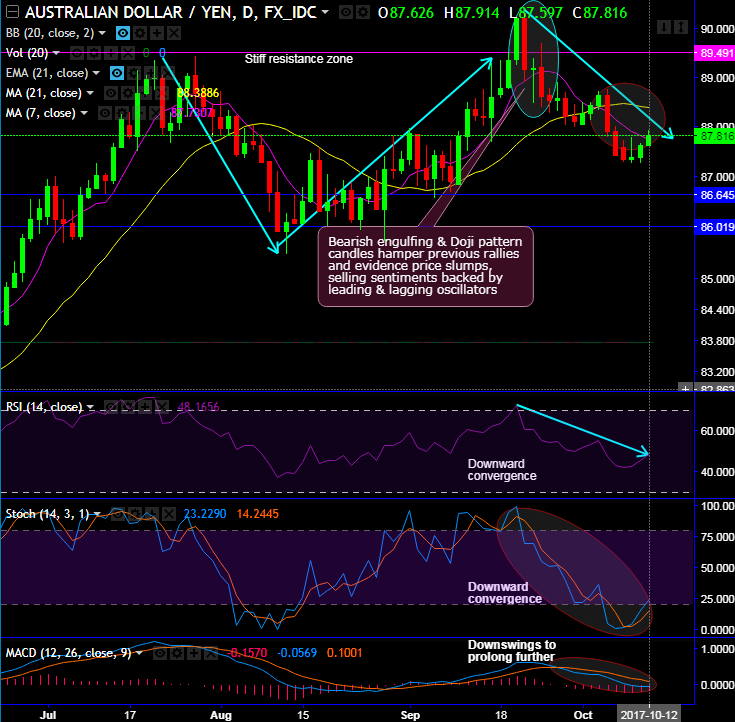

We traced out bearish engulfing and doji patterns on rallies of AUDJPY to hamper uptrend momentum, while the major trend seems to have been edgy near 61.8% Fibonacci retracements.

Bearish engulfing and Doji patterns have occurred at 89.163 and 89.165 levels respectively.

You could easily make out that these bearish pattern candles hamper previous rallies in short-term trend and evidence considerable price slumps from the highs of 90.305 levels to the recent lows of 87.252 levels (refer daily chart).

Most notably, the selling sentiments backed by leading & lagging oscillators on this timeframe.

On the flip side, the consolidation phase in the major trend has retraced more than 50% Fibonacci levels from the lows of June’2016 (i.e. 72.530 mark) but for now, the uptrend seems to be struggling for momentum as you can observe both RSI and stochastic curves are indicating overbought pressures.

Whereas both the lagging indicators (MACD & 7&21-DMA curves) signal the extension of consolidation phase only upon the sustenance above 87.514 (i.e. 50% Fibo levels) as bullish EMA crossover still uphold the uptrend continuation, MACD has no deviation from the buying trend sentiment, indicates the uptrend is likely to extend further (refer monthly terms).

Well, synthesizing both short-term selling and long-term buying sentiments in the consolidation phase, overall, the major trend seems to be creeping up or head towards sideways amid ongoing short-term hiccups.

Trade Tips:

Well, contemplating above stated technical reasoning, on speculative grounds we advise bidding tunnel spreads with upper strikes 88.010 and lower strikes at 87.511.

This strategy is likely to fetch leveraged yields than spot FX and certain yields as long as the underlying spot FX keeps dipping southwards.

Currency Strength Index: FxWirePro's hourly AUD spot index is inching towards -7 levels (neutral), while hourly JPY spot index was at shy above -74 (bearish) at the time of articulating. For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit: