Without wanting to bore you all with the details of the news flow on Brexit: the news that reached us over the weekend can all be interpreted in a GBP positive manner. However, Sterling is unable to benefit particularly on the Asian markets this morning.

The interpretation of that could be, positive news of the sterling, at current levels, are largely factored-in. The residual uncertainty does not justify a further GBP rally.

That also means: over the next few days the risks are asymmetrical. Any news that might shake the confidence of the markets will have major GBP negative effects. Such news is – it has to be said – rather unlikely though.

At present it looks as if the Brexiteers amongst the Tories are preparing for a total defeat. As became clear in the aftermath of the referendum: their pithy talk was largely hot air.

GBP OTC Updates:

The positive bids in the shorter tenors have been observed to the bearish risk reversal atmosphere in the GBP OTC markets, this is interpreted as the hedgers are keen on bullish risks in the short-run, whereas the long-term bearish outlook remains intact.

You could easily make out that the positively skewed IVs of EURGBP have been stretched out on either side. This is interpreted as the hedgers bid for both OTM calls and OTM put options.

A year on from last year’s catastrophic VIX shock that by all accounts had drawn a line under 2017’s anomalous low volatility regime, February 2019 is ending with G7 FX volatility re-testing cycle lows from 1Q18. 1M ATM vols across the majors have now fallen well below 6.0 (EUR 1M 5.5, JPY 1M 5.6); even at such low levels, VXY G7 is arguably being held up artificially to some extent by the idiosyncratic Brexit premium in GBP options (GBP 1M 10.1) and perhaps a lingering trace of US/China tensions in AUD (1M 8.3).

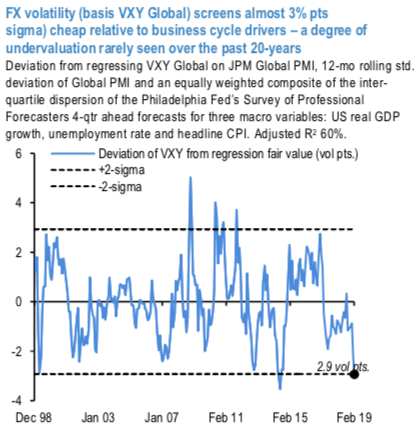

On the whole, FX volatility now screens 3% pts. too low, a hefty 2-std. error deviation from cyclical fair value (refer above chart) last witnessed during the great vol slump of 2Q’14 before mounting expectations of a Fed hiking cycle kicked off the dollar’s multi-year bull run, and before that only once prior to the EM upheaval of the late’90s. Courtesy: JPM

Currency Strength Index: FxWirePro's hourly GBP spot index is inching towards 37 levels (which is mildly bullish), while hourly USD spot index was at 112 (highly bullish) while articulating (at 14:54 GMT).

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics