Following the first successful vote on the pension reform in the Chamber of Deputies, it has now been announced that the second vote will not take place until August after the summer break. This announcement had no impact on the BRL because the risk that the reform will fail has decreased significantly in the past few days so that the euphoria in the market continues. A certain degree of caution, however, is justified, as the Senate still has to give its approval in two voting rounds. There is also the question of how much the government's original proposal will be watered down in the end.

In other words, will the reform bring enough savings to relieve the ailing state budget. Against this backdrop, the BRL rally could run out of steam.

With the recent developments, the upcoming interest rate decision at the end of the month has gained attention. The central bank had always stressed that reforms were important to ensure a low inflation environment. Will the recent success therefore suffice for the central bank to lower its key interest rate? In view of the already historically low key interest rate, the central bank should weigh very carefully and take no hasty steps. Yesterday's publication of economic activity for the month of May could make a rate cut less urgent, as activity increased by 0.54% compared to the previous month. The central bank may see this as a confirmation that the economy will recover in the course of the year. Inflation data which is due for release next Tuesday may provide another indication for the upcoming central bank meeting.

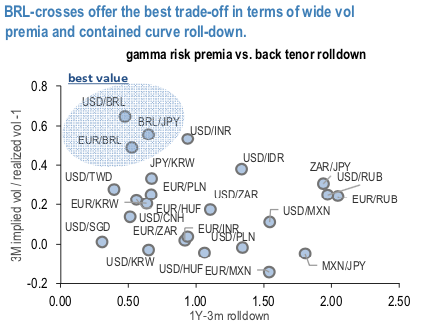

When focusing on pure vol plays, a natural implementation for the short EMFX vol theme is via delta-hedged calendar spread, where the short-vol leg benefits from the vol carry and the long leg serves as a hedge. At current market, BRL-crosses stand as the best calendars with their wide vol premia and contained curve roll-down (refer 1st chart). SVM based gamma trading model sees BRL vols as strong tactical sell (TWD being the only other pair among the G10 and EM pairs that we track in the SVM model). Moreover, across a set of liquid EM-pairs BRL screens as one of the best systematic performers (refer 2nd chart). Three implementations for milking BRL vol carry:

Vol calendar expression: To asses a risk from sell-offs to the short gamma leg we analyze past episodes of SSR vote optimism and disappointments particularly focusing on the drawdowns that occurred during the sharp selloffs (refer 3rd chart). The so-called “Temer tapes” in May 2017 and the April/May 2019 vote delay disappointment show 3vol and 2vol losses, respectively. The losses got pared within 1 quarter. A back of the envelope calculation indicates that a sharp, one-day 2.5% move could correspond to about 1.5vol loss even if no change in the BRL vols. The current 3M impl – realized vol gap (>4vols wide) should well sustain a 1.5vol hit on the bottom line assuming that the large spot gyrations do not persist. Keeping in mind the risks, we recommend:

Delta-hedged short 3M 25 strangle@ 11.95/12.3ch vs. long 12M straddle in USDBRL @12.9ch indic vols, in vega neutral notionals. Courtesy: JPM & Commerzbank

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts