The Bank of Japan (BoJ) surprised the market Friday by increasing its buying in 5-10 year bonds, trying to keep the 10-year JGB yields near zero. This move comes after the central bank unexpectedly skipped widely anticipated bond-buying operations in shorter maturities, which and pushed JGB yields higher.

Markets now wait to watch the decision of the BoJ at its 2-day monetary policy meeting, that is scheduled to be held on January 30-31st, the central bank likely to stay pat as per the forecasts.

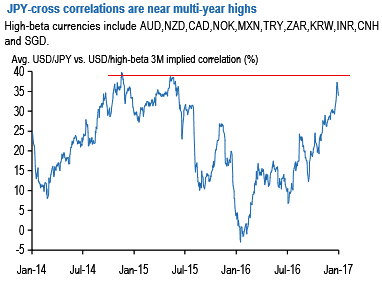

The concerted surge in the dollar since the US elections has lifted many boats, including correlations between USD/JPY and USD/high-beta pairs to multi-year highs that have historically offered stiff resistance (refer above chart).

There is a soft cap on how far correlations can rise beyond this point between a low-yielding funding currency like the yen and other pro-cyclical FX, which leads us to think that the next major thematic move in USD-correlations lower will likely be led by a de-coupling of JPY-(and possibly EUR-) crosses in response to a worsening risk backdrop.

We still await a turn in realized correlations to pull the trigger on a broad swathe of cross-yen trades, but highlight the following as potential opportunities created by the extreme set-up that are monetizable at the current market:

Digital JPY calls vs. CAD and KRW as protectionism hedges.

USD/BRL/JPY correlation triangles as quasi-hedged carry trades.

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action

BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks