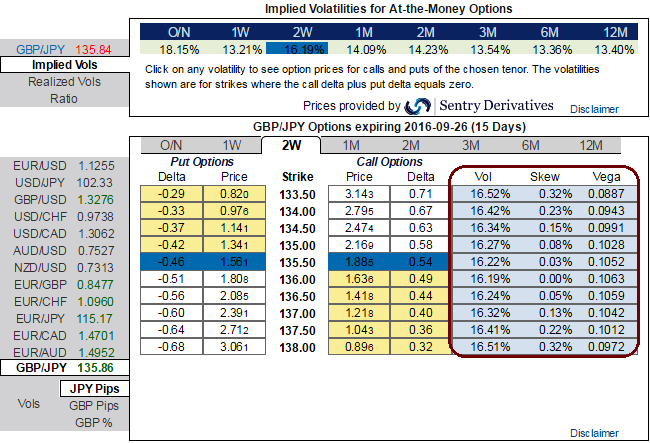

1W and 2W ATM IVs of GBP crosses are rising dramatically in OTC markets, GBPJPY flashing more than 13% and 16% respectively ahead of this week’s monetary policy by Bank of England which is likely to stand pat but previous minutes hint on more easing on the cards.

Please have a glance on how implied volatilities skews of ATM puts of 1w and 2W are positively correlated to the OTM strikes on both calls and puts.

Data front, BoE on Thursday will be the major focus, with the inflation report seeing expected effects from Brexit on the real economy. Markets awaits further stimulus in the days to come, to price about 80% chance for another 25bp cut in Bank rate in upcoming future and some looking for more QE. PMI of all services, manufacturing, and construction sectors have been improved this time according to the previous stimulus in BoE’s monetary policy.

In spot FX of GBPJPY, technically the pair has again drifted below EMAs and DMAs to the current 135.860 levels, what is weighing on the pound's slumps is that, the expectations on BoE monetary policy changes but the chances for lower interest rates in rest of the 2016 has grown up, above all lingering post Brexit formalities adding an extra pressure on sterling's depreciation.

Hence, we advocate the suitable option strategy to hedge the potential downside risks by using any small bounces through ITM shorts; this would have certainly ensured returns in the form of premiums.

With the above technical and fundamental reasoning, we reckon to arrest potential downside risks of this pair by hedging through Put Ratio back Spread and accordingly, hedging framework was also suggested earlier, for now, it is reckoned that the underlying currency GBPJPY to make a large move on the downside.

So, stay firm with longs on 2 lots of 1M At-The-Money vega puts that would function effectively in higher IV times, long instruments to generate positive cash flows as underlying spot keeps declining, simultaneously, short 1 lot of OTM put with 1-week expiry.

The Vega would be at its maximum when the option is at ATM and declines exponentially as the option moves ITM or OTM owing to every tiny shift in IVs that will make no difference on the likelihood of an option far out-of-the-money expiring ITM.

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist