BoE governor Mark Carney is scheduled to deliver a speech, usually, as head of the central bank, which controls short-term interest rates, he has more influence over the nation's currency value than any other person. Traders scrutinize his public engagements as they are often used to drop subtle clues regarding future monetary policy.

In the recent past, he has warned that new financial technology could damage the business model of traditional banks as savers turn away from mainstream lenders.

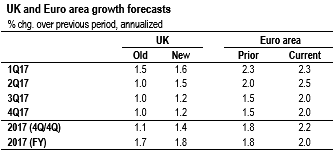

Well, JP Morgan has recently upgraded 2017 GDP growth forecasts but continue to expect a slowdown during the year.

While scope for some more hawkish rhetoric from the BoE, but expectation that the majority to hold rates this year.

Some limited payback expected in March inflation.

This week we revised up our 2017 growth forecast to reflect a more positive European growth backdrop and a slower-than-expected loss of momentum in some of the business output surveys in 1Q. Although some of the more hawkish MPC members may dissent this year, we expect the majority to stay patient on rates in anticipation of weakening consumer spending growth.

Our growth revisions raise our full-year 2017 GDP growth projection by 0.2%-pt to 1.9%. And the average quarterly annualized pace has risen by 0.3%-pt, from 1.1% to 1.4% (refer above table). The upgrade is larger in 1H17 (0.4%) and reflects some surveys’ greater than expected resilience, including in this week’s March services PMI. The upgrade to 2H17 is smaller (0.2%) and reflects the changes we made last week to our Euro area growth forecast.

Despite these revisions, our 2017 full-year growth forecast remains slightly below the BoE’s 2.0% forecast. The larger forecast change for the BoE at next month’s Inflation Report likely will be to inflation, where we expect it to raise its existing 4.2% 2017 CPI forecast closer to our current 2.7% projection.

Together with the stronger global outlook, this could encourage some of the shy hawks on the MPC to vote for higher rates at the upcoming May meeting. But we continue to expect the majority to have an eye on the weak path for real incomes this year, and signs from the latest data that a consumer slowdown already is under way. As a result, most on the MPC should resist the temptation to support higher rates, at least until it becomes clearer how the consumer is responding to the purchasing power squeeze.

Recent MPC commentary appears to support this view. Although Vlieghe is the most dovish on the MPC, his comments in a speech this week highlight a cautious stance on rates due to concerns about the consumer, and limited policy easing options available to the MPC in the event of a more significant slowdown. Even relatively hawkish McCafferty sounded concerned about the consumer this year in comments last week.

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty