The BoE has reversed the pre-emptive interest rate cut after the Brexit referendum in 2017. However, as this does not mark the start of a hiking cycle, monetary policy will no longer give any momentum.

Even if it Britain and the EU will start phase II of the Brexit negotiations in the coming months, the process remains extremely slow and tedious, not least because of the tensions within the British Government.

The pound thus remains the pawn of progress or setbacks in the Brexit negotiations and thus volatile. The downside risks also prevail in 2018.

On the flips side, the Bank of Canada (BoC) has become more meticulous again as CAD appreciated heavily following two rate hikes, but then, monetary policy to be more decisive than oil prices in the days to come. The oil performance has been instrumental in boosting the currency in 2017, even though the long-term picture suggests that the currency has overshot the rebound in oil prices.

However, the CAD is on the right track to remain strong: the interest rates factor is taking over from the commodity factor. CAD rates recently climbed above USD rates for the first time since 2014 (Graph 1), and our USD rates projections can realistically drag the USDCAD to 1.20.

In view of numerous risks (inflation, oil price, NAFTA) the BoC does not want to be overly optimistic.

We assume that for the time being the BoC will initially follow the Fed’s rate hike speed so as to prevent strong CAD appreciation against USD. The better growth outlook in Canada, as well as the more stable political environment, will, however, allow gradual CAD appreciation in the future.

Option Strategic Framework:

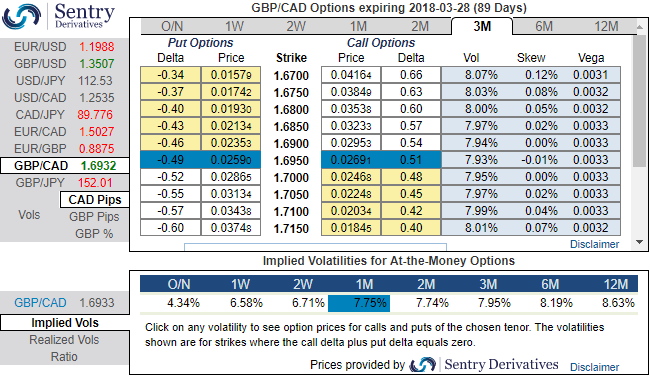

Please be noted that the positively skewed IVs of 3m tenors of this pair is well balanced on either side, while technical trend and above stated fundamental driving forces of this pair have been indicating mounting selling pressures which means hedgers’ sentiments that the pair may head towards any directions with more potential on downside in near term.

Accordingly, we advocate below options strategy that is likely to optimize hedging motive.

Strategy: 3-Way Options straddle versus OTM call

Spread ratio: (Long 1: Long 1: Short 1)

How to execute: At spot reference: 1.6933, initiate long in 3M GBPCAD at the money +0.51 delta call, add one more lot of 3M at the money -0.49 delta put and simultaneously, short 1m (1%) out of the money call with positive theta. The short leg with narrowed expiry (lower side) likely to reduce total hedging cost.

OCBC Raises Gold Price Forecast to $5,600 as Structural Demand and Uncertainty Persist

OCBC Raises Gold Price Forecast to $5,600 as Structural Demand and Uncertainty Persist  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action

BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  U.S. Urges Japan on Monetary Policy as Yen Volatility Raises Market Concerns

U.S. Urges Japan on Monetary Policy as Yen Volatility Raises Market Concerns  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons