The FOMC meeting next week is also likely to stay on script. We do not expect the Fed to use the July FOMC statement to push up market expectations for a September hike. While recent data and the easing in financial conditions in the US have increased the possibility of a hike in September, we think the Fed will wait before committing to this.

We believe the July FOMC statement will acknowledge the recent improvement in activity, but state that the committee needs further evidence of progress on the dual mandate, before signaling to markets that another rate hike is coming.

On the flip side, the BoJ announcing “helicopter money” is unlikely, in our opinion. Instead, we expect it to cut IOER further and increase ETF/JREIT purchases at next week’s meeting.

Hedging strategy to mitigate downside risks: Put Ratio Back Spreads (PRBS)

Although the Fed will likely to remain on the sidelines in this monetary policy, the improving domestic backdrop supports our view that the Fed would continue on with its gradual tightening cycle in September.

We think current macro situations lead the fed to almost defer policy actions to June meeting, but manipulative statements on monetary policy outcome may keep USDJPY at stake.

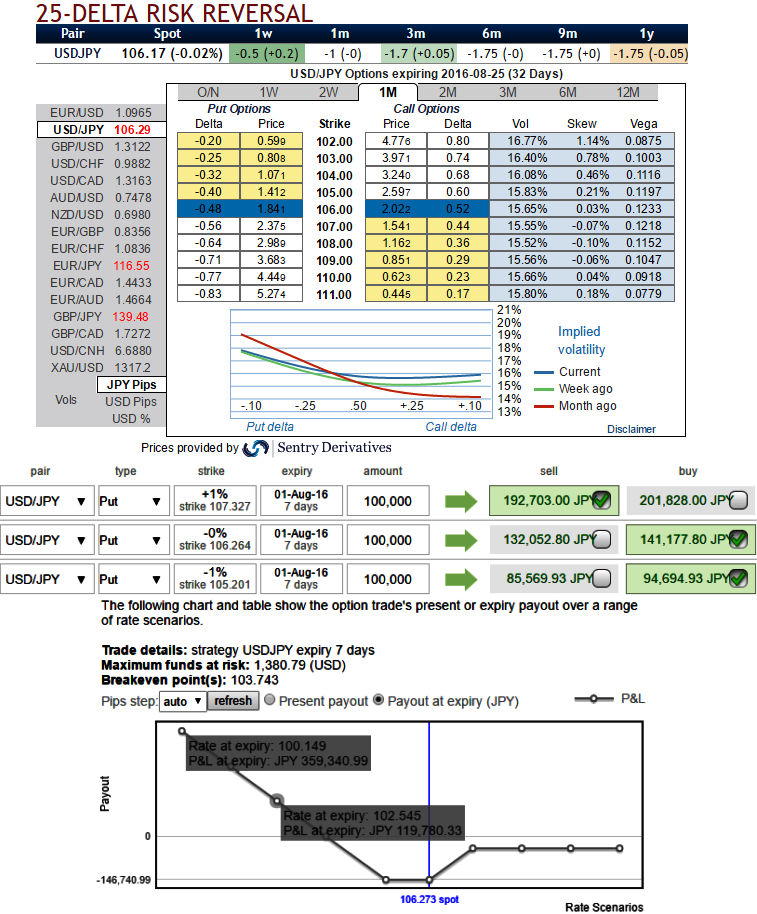

So, on hedging grounds, short ITM put with shorter expiry since implied volatility is spiking higher when risk reversals are positive comparatively to 1m expiries which is good for option writers ahead of data season, since the signals for long term downtrend are still intact, so the strategy continues this way, go long in 2 lots of ATM and OTM put with longer expiry (per say 2M expiries) and simultaneously short 1W ITM puts with positive theta values.

Rationale behind USDJPY pressures for upside potential in short run and downside risks in long run: We can very much empathize the dollar against yen to gain slightly at least in short run (let's say next 1 week or so) with an anticipation of Fed may rise in September considering global economic slowdown but IV skews in 1m tenor still suggest hedging interest in OTM put strikes.

From delta risk reversal and IV reasoning, the yen crosses is still considered to be one of the weakest currency crosses among entire G20 currency space in long run but positive recoveries in risk reversal numbers, so we believe any short upswings are the best advantage for bears and may be utilized for shorts in hedging strategies so as to reduce the hedging costs.

(Compare delta risk reversal with last week), the market pin risk in FX option market, you see the sizeable open interest for 105.50 or below strikes for one-month expiries which means more number of outstanding contracts up to those levels.

Most importantly, the pair is likely to perceive implied volatility close to 25% of 1W ATM contracts with positive risk reversals, 15% with an increase in negative risk reversals during 1m tenor, thus we recommend deploying back spreads.

Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close