Larry Kudlow, the director of the des National Economic Council, signaled that US President Donald Trump and the Chinese President Xi Jinping would hold talks during the G20 summit in Osaka (28th and 29th June). Will that ends the trade war between the two nations? The economists are convinced that an agreement will be reached in the foreseeable future. Osaka would be a good opportunity to reach it. It is still a while until then but the economic damage the tariffs are causing until then would be limited.

But of course, the FX market does not tick like an economist. On the market risks rather than convictions have to be translated into prices. And one thing has become clear over the past days and weeks: that quite a lot can go wrong in this negotiating process. Moreover, the most impressive current news flow consists of the US President’s tweets. And if one reads that one is overcome by concerns that the moment when all bridges have been burned and constructive talks are no longer possible cannot be far off.

Due to the remaining risks the market is unable to share lingering optimism, despite all the convincing arguments and is instead of assuming a risk-off attitude: USDJPY trades below 110, EURCHF below 1.1360. What springs to mind in this situation is that the dollar does not act as a safe haven so that nothing significant is happening in EURUSD.

However, this was not exactly a straightforward week for the portfolio, as our basket of USD longs was initially pressured by the market’s willingness to entertain the notion of the Fed taking out insurance rate cuts.

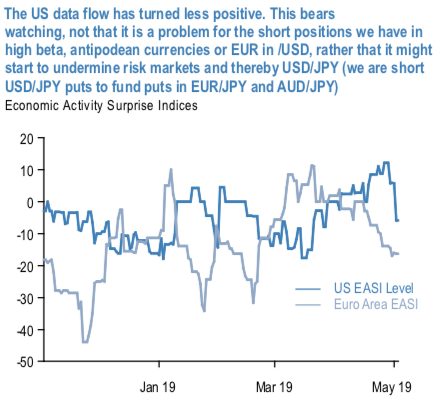

Should the dollar be particularly troubled by the slippage in the US data surprise index, which has dropped from +12 to -5 in the space of a week (refer 2ndchart)? We wouldn’t ignore this moderation in the US data flow since there has been an undoubted hint of US exceptionalism running through the dollar's recent good run. That being said, the US data surprises are still outperforming the Euro area, so we doubt whether softer US data can yet support EURUSD.

Stay short EUR vs USD and JPY in cash and options Euro area developments took a back seat to the Fed this week. The main domestic development of note was the four-tenths spike in the region's core CPI in April to 1.2%.

Impressive though this was, the strength in inflation was largely superficial in that it owes much to the vagaries of the Easter vacations and impact of this on holiday prices. It’s probably best to average the March and April readings and doing so yields a conclusion that core is stuck around 1.0%, in line with the average since early 2018. Core inflation should edge higher into year-end, but a move to 1.2-1.3% shouldn’t transform expectations for ECB policy. These remain in thrall to an economy that is struggling still to get out of first gear – despite being revised up to a tenth, the final manufacturing PMI for April gives little reason to celebrate, either in terms of the outright level (47.9) or the small downgrade in the manufacturing heartland of Germany.

In our view, the currency should continue to slip until such time as there’s sufficient evidence that the economy can sustain the growth of much above 1%. Good though the 1.6% SAAR gain in 1Q’19 was, it was partly payback from the scant growth of 0.7% in 2H’18. And even with that, it was still only half the growth in the US.

Trade tips:

Short EURUSD from the end of April. Marked at - 0.15%.

Hold a 3m EUR put/USD call, strike 1.10. Paid 35bp at the ending of March. Marked at 23bp.

Stay long a 3m EUR put/JPY call, strike 121.50 vs short a 3m USD put/JPY call, strike 108.50. The total net premium received 24bp. Marked at -0.19%. Courtesy: JPM & Commerzbank

Currency Strength Index: FxWirePro's hourly EUR spot index is inching towards 33 levels (which is mildly bullish), while hourly USD spot index was at -14 (mildly bearish) while articulating (at 07:31 GMT).

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action

BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand