The ECB’s zero interest rate policy makes the persistently high debt levels of consumers and businesses sustainable. This debt is, therefore, no obstacle to higher consumption and investment expenditures. On the other hand, the decline in the PMI for the service sector, which was closely correlated with the change in GDP in the past, shows that growth has its limits even in the eurozone.

We assume that in Q3 and Q4 real GDP will grow at a rate of 0.5% each, which would be slightly lower than in the preceding three quarters (0.6% on average). The ECB will note today’s data with satisfaction. The strong growth will enable the central bank to make the inevitable reduction of its bond purchases in 2018 seem fundamentally justified, as strong growth will also boost inflation over the medium-term.

As per SG projections, a nine-month extension and an aggressive reduction from €60bn to €25bn. This would add €225bn to the stock of bond holdings next year. The program will remain open-ended which gives the ECB the flexibility to extend purchases again into 2019 should economic conditions warrant (too low inflation). The reduction to €25bn also deals with the increased scarcity of the bond universe. The ECB can only hold 33% of a particular bond issue on a nominal basis. The remaining bond universe amounts to €200-300bn.

The current option market pricing of 20% overnight vol in EURUSD for the October meeting (refer above table) implies a 0.84% daily spot breakeven on the day, which is closer to the upper-end of our estimated range of EURUSD spot moves between 0.5% -1.0% depending on the tapering package that the Bank announces. The degree of asymmetry in expected spot moves vis-à-vis current vol pricing is not enough in our view to motivate owning event risk premium over Thursday. One aspect of short-dated EURUSD vol surface pricing that does strike us as anomalous is the cheapness of forward volatility priced for after the ECB meeting.

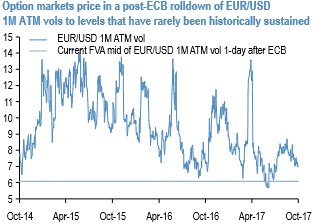

The above nutshell illustrates that the event vacuum after the October ECB is reflected in a1 vol+ rolldown of 1M ATM vols post meeting. The absolute level of the forward vol matters too: 6.1 as the forward level of EURUSD 1M ATM vol after the meeting date at the time of writing is extremely low and has rarely been reached let alone sustained judging by the history of EURUSD 1M vol in recent years (refer above chart).

Additionally, Euro spot has been realizing 6.0 -6.5% in recent weeks even in a quiet market, so there is no risk premium priced into forward vols for any unexpected dollar volatility brought about by either a re-pricing of Fed expectations or more trade/NAFTA/fiscal noises out of Washington. Owning post-ECB forward vol is therefore much better risk-reward in our view than buying the event itself.

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness