Although NZDJPY shows interim rallies, these upswings seem to be momentary as the overbought pressures signal weakness. The decline in January could extend below 70.00 if the coronavirus epidemic persists. Event risk during the next week comes from wage data and a leading index.

Hence, it is wise to capitalize on interim rallies and optimize ‘debit put spreads’ ahead of RBNZ’s monetary policy that is scheduled for the next week. The kiwis central bank cut 50 bps in its August meeting and had said that there was room to cut further "if required." We interpret this as an easing bias rather than a signal. In other words, the RBNZ views a cut as more likely than a hike, but is not committing to either at this point. We reckon that the prevailing rallies of NZDJPY are momentary, NZD is expected to depreciate towards 67 levels by year-end.

Before we deep dive into the hedging framework, let’s just quickly glance at the bullish and bearish driving forces of NZDJPY.

Bearish NZDJPY scenarios:

1) Tightening by banks forces a deeper slowdown in credit growth, and weakens the agricultural sector;

2) The immigration rolls over more quickly.

3) The global investors’ risk aversion heightens significantly;

4) Global economy enters serious recession; and middle-east tensions escalate sharply.

5) The decline in January could extend below 70.00 if the coronavirus epidemic persists as China has been Kiwis' major trade partner.

Bullish NZDJPY scenarios:

1) NZ fiscal easing is accelerated;

2) NZ housing lifts more meaningfully thanks to a winding back of LVR restrictions.

3) The momentum in JPY selling flows related to outward portfolio investments and FDI strengthens further.

OTC Updates, Trade and Hedging Recommendations:

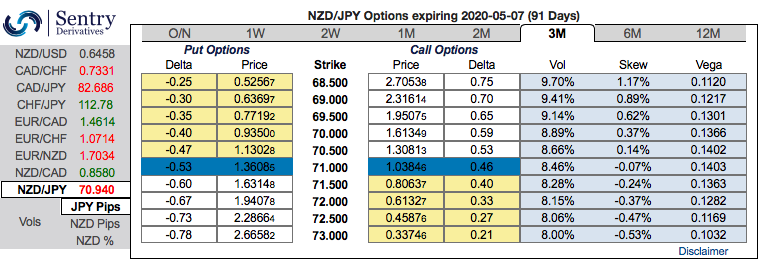

3m IV skews are right indications for NZDJPY that have still been indicating bearish risks. The major downtrend continuation shouldn’t be panicked the broad-based bearish outlook amid minor rallies.

The positively skewed IVs of 3m tenors signify the hedgers’ interests to bid OTM put strikes up to 68.50 levels (refer above nutshells evidencing IV skews).

Hence, initiate longs in -0.49 delta put options of 3m tenors, simultaneously, short (1%) out of the money put options of the narrowed expiry (preferably 2w tenors), the strategy is executed at net debit (spot reference: 70.957 levels).

Well, a higher (absolute) Delta value is desirable on long leg in the above stated strategy. Whereas, the Theta is positive on short leg; as the time decay is good for an option writer (that’s why we’ve chosen narrowed expiry). The short side likely to reduce cost of hedging with time decay advantage on short leg, while delta longs likely to arrest potential bearish risks.

Alternatively, shorts in the mid-month futures have been advocated with a view of arresting further downside risks. Courtesy: Sentry

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge