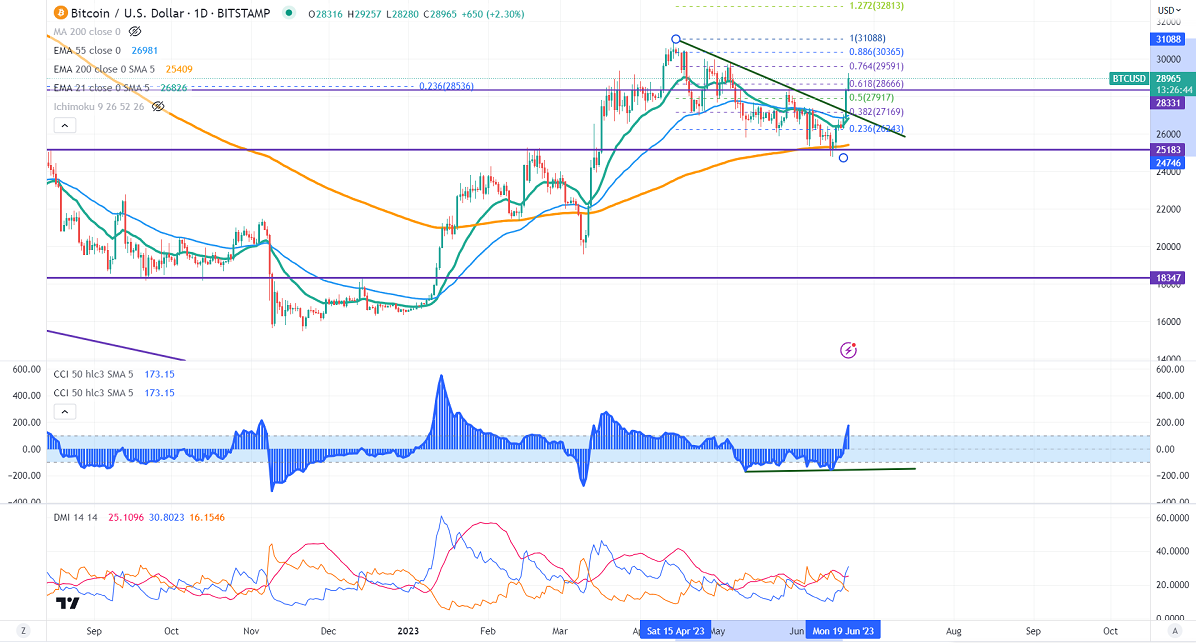

Chart pattern- Bullish divergence

BTCUSD regained its positive momentum and surged above $4000 on upbeat market sentiment. The institutional investor's sentiment was boosted after Black Rock and Invesco applied for spot Bitcoin ETF. BTC hits an intraday low of $29014 and currently trading around $28966.

Major economic data for the week

Jun 21st, Fed Chair Powell testifies (2 PM GMT)

Factors to watch for Bitcoin price action-

US markets -

NASDAQ (positive correlation with BTC) - Bullish (neutral for BTC). The correlation between Bitcoin and NASDAQ diverged and 40 -the day correlation dropped to 0.19. Any weekly close above 15000 will take the index to 15300/15500.

According to the CME Fed watch tool, the probability of a 25 bpbs rate hike in July increased to 76.90% from 60.3% a week ago.

Technicals-

Major support- $27500. Any break below will take it to the next level at $25000/$23800/$23300 if possible.

Bull case-

Primary supply zone -$30000. The breach above confirms minor bullishness. A jump to the next level of $32375/$36300/$40300/$41349 is possible.

Secondary barrier- $42600. A close above that barrier targets $48800/$50000.

It is good to buy on dips around $27500-600 with SL around $24500 for TP of $35000/$40000.