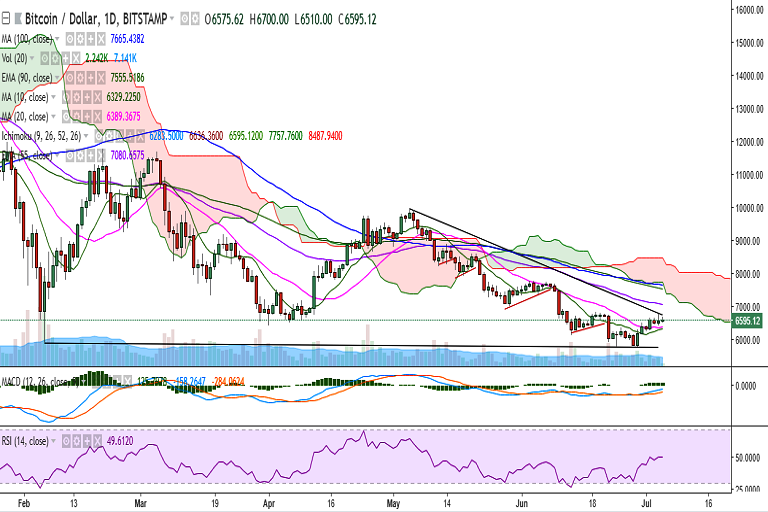

BTC/USD remains rangebound on Thursday as it tested key resistance at 4h 200-SMA. It is currently trading at 6600 levels at the time of writing (Bitstamp).

On the upside, a decisive break above 6724 (4h 200-SMA) would target 6909 (Upper Bollinger)/7038 (50-DMA). Further strength would target 7170 (23.6% retracement of 11688 and 5774.72).

On the downside, a break below 6507 (1h 100-SMA) would see the pair testing 6389 (20-DMA)/6300. Further weakness would drag it to 6151 (4h Cloud top)/6000.

Momentum studies: On the daily chart, RSI is at 49 with upward bias, stochs are near overbought levels, and MACD line is above the signal line, suggesting scope for further upside.

However, the bearish divergence in stochs and RSI on the 4h chart calls for high caution (chart below).

Recommendation: Wait for clear directional bias.

FxWirePro: BTC/USD tests key resistance at 4h 200-SMA, bearish RSI and stochs divergence call for high caution

Thursday, July 5, 2018 7:28 AM UTC

Editor's Picks

- Market Data

Most Popular

Iran Unrest Sparks Oil Rally — Bounce Off EMA, Buy Dips to $66.40 Glory

Iran Unrest Sparks Oil Rally — Bounce Off EMA, Buy Dips to $66.40 Glory  FxWirePro: USD/ZAR dips below lower range, bearish bias increases

FxWirePro: USD/ZAR dips below lower range, bearish bias increases  FxWirePro: NZD/USD consolidating around 0.6030 , bias is bullish

FxWirePro: NZD/USD consolidating around 0.6030 , bias is bullish  FxWirePro- Woodies Pivot(Major)

FxWirePro- Woodies Pivot(Major)  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  NZDJPY Bulls in Control: Buy-the-Dip Setup Points to 96 Target

NZDJPY Bulls in Control: Buy-the-Dip Setup Points to 96 Target  FxWirePro: GBP/NZD outlook weaker on renewed downside pressure

FxWirePro: GBP/NZD outlook weaker on renewed downside pressure