Q3 GDP next week looks set to show a sharp slowdown, with our preliminary estimate being flat QoQ growth. This would see annual growth drop to 2.3% from 3.3% in Q2, well below the RBA’s implied forecast of approximately 3%.

We expect that the weakness in GDP will prove short-lived. Today’s retail sales report showed momentum improving sharply into Q4, while housing construction is likely to rebound given the amount of work still in the pipeline.

At next week’s RBA Board meeting, we expect much discussion would revolve around the labor market and the ongoing weakness in wages growth but simultaneously, the central bank likely to stand pat in its cash rates that could bolster AUD strength a bit.

While in the near term the Italian referendum may support some pick-up in volatility, we continue to think that USD strength will remain the main driver of the AUD. Next week, the RBA and Q3 GDP in Australia should have only a limited impact on the AUD.

OTC Updates and Hedging Framework:

It seems rational that antipodeans currency crosses as “high yielding” avenues that suffer more as a result of the USD strength than most other G10 currencies.

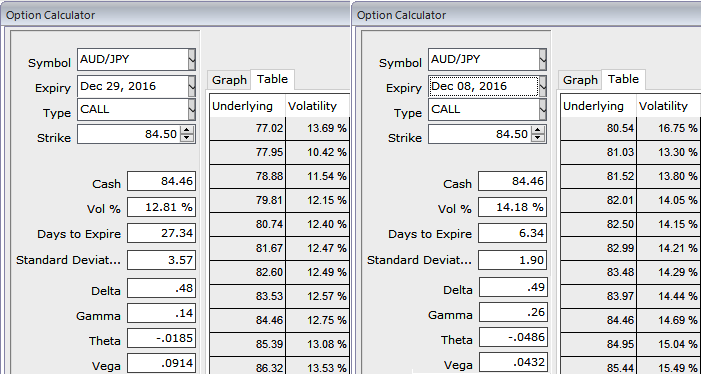

1w at the money volatilities of 50% delta calls and puts are at trading around 12.28% and 13.16% for 1m tenors which is reasonable as the vols currently are working in the interest of option holders in month tenor as you can see IVs and corresponding movements in vega.

Please also be noted that the 1w ATM call is trading exorbitantly at 14% above NPV, while 1m calls trading little cheaper (8.5%) than 1w contracts, hence, we reckon 1m derivative instruments are more beneficial than 1w tenors in comparison with IVs.

We think 1w AUDJPY IVs are rising above 14.18% having significance economic drivers (including RBA monetary policy and GDP announcements) that stimulate the turbulence of the underlying currency pair. However, 1m IVs are also reasonably on the higher side at 12.81%.

As stated in our recent post on the technical write up, we look ahead for more rallies up to 86.379 on break-out above resistance at 81.520 and bullish SMA crossover.

The current prices spike above SMAs, EMAs & channel resistance after testing strong support at 76.175.

Hence, it is advisable to hedge upside risks, we recommend option strap strategy that favors underlying spot’s upside bias.

So, we recommend building the FX portfolio exposed to this pair with longs positions in 2 lots of 1M ATM 0.51 delta calls and 1 lot of ATM -0.49 delta puts of the same expiries.

As shown in the diagram, this AUDJPY option straps strategy should take care of both upswings and any abrupt downswings just in case RBA surprises the forecasters, and the strategy is likely to derive handsome returns on the upside and certain yields regardless of swings on either side but with more potential on the upside.

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed