The RBA is scheduled for their monetary policy on March 3rd and the Aussie central bank has begun 2020 with a sanguine view of the domestic and global uncertainties clouding the outlook. The Board’s discussion of these factors will be critical to assess when the minutes are released.

AUDUSD has been consolidating in the low 0.67 areas upon the lingering apprehensions of contagious coronavirus.

The medium-term perspectives: The AUD, as a proxy for global risk sentiment and also for China’s growth outlook, will continue to be buffeted by COVID-19 concerns.

The major downtrend remains intact as the global risks are expected to persist. Especially, Chinese growth and trade are going to get trauma owing to disastrous & contagious coronavirus attack and China is the trade partner for Australia.

The outbreak of a novel coronavirus (2019-nCoV), which originated in the central Chinese city of Wuhan, has now been declared a global emergency by the World Health Organization. The virus has already spread to the extent that it will have have a negative impact on China's economy. The Economist Intelligence Unit plans to revise its baseline forecast for China’s real GDP growth in 2020 to 5.4%, from 5.9% currently—and now poses a risk to the global economic outlook.

This means two-way price action, but we prefer to sell into any rallies towards 0.68. The cyclical effects are fragile industrial commodities and the China travel ban threaten each of Australia’s top 5 exports (coal, iron ore, LNG, education, tourism), pointing to a collapse in the trade surplus starting in the Jan data. The RBA’s growth optimism lends AUD some support with low risk of easing near term but we still see two rate cuts this year as unemployment starts to trend higher. Multi-week risks to 0.66 or below and 0.66 by end-June.

OTC Outlook of AUDUSD and Options Strategic Framework:

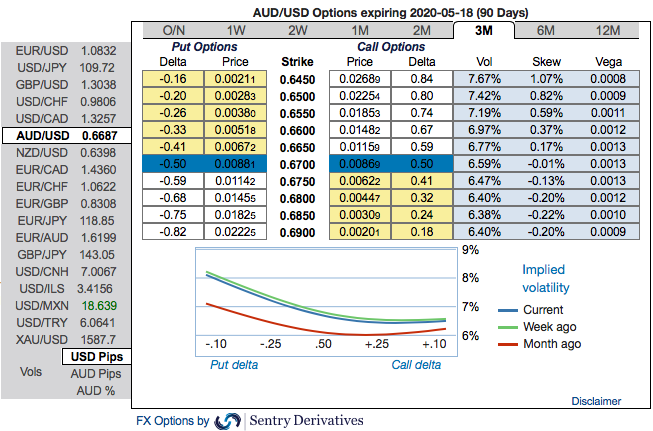

The positively skewed IVs of 3m tenors are also in line with the above predictions, they still signify the hedgers’ interests to bid OTM put strikes up to 0.6450 levels (refer 1st nutshell).

Please also be noted that we see fresh bids for current bearish risk reversals (RRs) setup across all the longer tenors are also in sync with the bearish scenarios (refer 2nd (RR) nutshell).

In a nutshell, AUD OTC hedgers’ sentiments substantiate that their risk mitigating activities for the further downside potential has been clear.

Accordingly, diagonal put spreads are advocated to mitigate the downside risks with a reduced cost of trading.

The combination of AUDUSD’s short-term potential to hit 0.70 and fails from there onwards several times amid lower IVs is luring for the OTM put options writers. While the medium-term perspective is attractive for bearish hedges via ITM puts.

The execution of options strategy: At spot reference: 0.6687 level, short 2w (1%) OTM put option with positive theta (position seems good even if the underlying spot goes either sideways or spikes mildly), simultaneously, add long in 2 lots of delta long in 3m (1%) ITM -0.79 delta put options.

We keep reiterating that the deep in the money put option with a very strong delta will move in tandem with the underlying. Courtesy: Sentry and Saxobank

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data