The dramatic equity market plunge in the recent times, the sentiment gyrations amid mounting apprehensions of COVID-19 across the globe, energy & precious metal commodities (including crude oil & gold) and awfully, the state of global economics have broken the markets and left a number of dislocations in FX vol space. Challenging liquidity stands in the way.

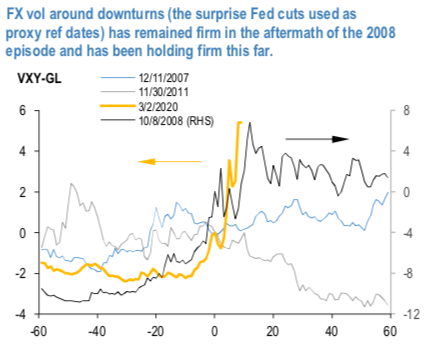

Fx vols around the similarly challenging past episodes (proxy with surprise Fed cuts) look mixed (refer 1stchart). Namely, FX vols remained firm in the aftermath of the 2008 episode, declined in 2011 and have been holding firm following the last week’s cut. It would be a stretch to compare magnitude of the ongoing vol episode with the one from 2008, but we do expect to see similarly persistent tail vol profile. Until a more robust policy and government response to COVID-19 the economic and political uncertainty are in the cards and keep us defensive for longer.

Long yen 3m3m fwd vols 2-sigma value: Amid the souring sentiment in conjunction with the rapid spread of COVID-19 to the western economies and the oil kerfuffle, a number of FX vol surfaces got twisted to a degree not seen in more than a decade, JPY vols and x-vols particularly so. The jump in gamma pricing and the consequent sharp curve inversion (1.5vol of inversion on 1M-2M segment for VXY-GL) has seen the bulk of the FX universe fwd vols in buy territory (refer 2nd chart), if compared with spot vols. Flip/flopping FX gamma makes liquidity and pricing challenging for the vol markets. With that in mind yen fwd vol stands out among the majors.

We expect FX spot gyrations to continue, but suspect that partial breakdown in safe haven correlations may be indicating that the global backdrop is messy but not necessarily as dire as the market sentiment suggests. We prefer owning 3m3m fwd vols which are (at mids) 2 sigma too low vs the ATM vols (refer 3rdchart). 1vol b/o on 3m3m FVA (more than twice the historics) is an impediment.

Performance of the long 3m3m FVA exhibits positive correlation with vol levels while offering a contained time decay during bearish trends for vols. Specifically the 4th chart back-test shows 3m3m USDJPY FVAs performing efficiently during major yen vol rallies (shaded episodes) and retaining P/L even as ATM vol starts to normalize lower. Courtesy: JPM

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis