The Reserve Bank of Australia (RBA) minutes of the May meeting left scope for interpretation, the RBA governor Philip Lowe was very explicit in his subsequent speech: in June the bank was going to consider the case for lower interest rates. In view of his comments on inflation as well as the growth and labor market outlook, this can only be seen as the announcement of a rate cut. For the FX market that is no reason to change its outlook significantly, as it has been expecting rate cuts for some time now – certainly since the last labor market report. It clearly not only plays a role for RBA that the last labor market report illustrated a slightly higher unemployment and underemployment rate. What is instead likely to be decisive for the decision is that the RBA is forecasting a renewed rise of the Australian growth rate to 2.75% and a stable unemployment rate of 5% but that this development assumes rate developments in line with market expectations.

We have been forecasting two rate cuts for this year since February 21. At the time, these forecasts were non-consensus. We are now bringing forward the timing of our rate cuts to June and August, from August and November previously.

Many analysts did not expect the RBA to have cut in May, but we conceded it would be a close call. In recent weeks, we have highlighted that June is a live date. Both the board meeting minutes and Lowe’s speech today has clearly spelled out a rate cut is on the way in June.

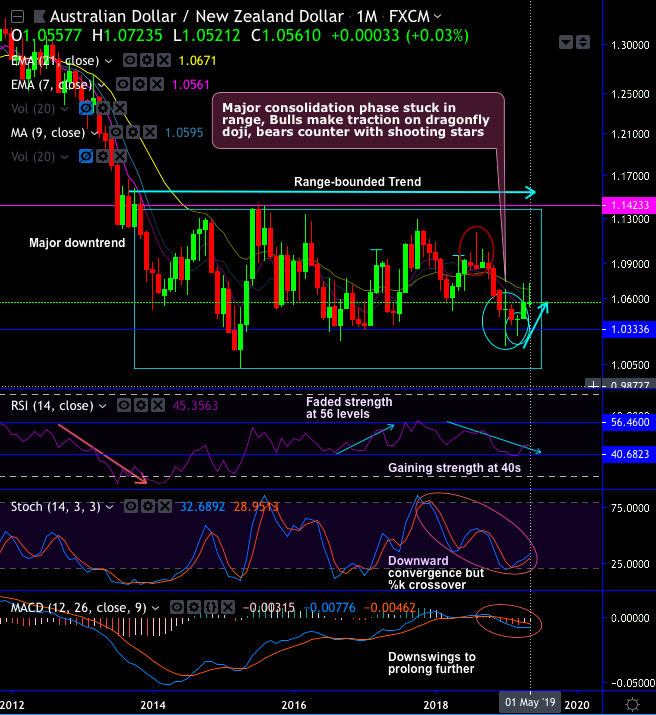

As you could observe AUD’s underperformance in the medium term perspective since August 2018, was majorly due to the cooler outlook for global growth, with China especially in focus, as well as growing expectations of RBA rate cuts. AUDNZD is extremely undervalued, according to interest rates and commodity prices, and there are early signs of a reversion towards fair value which could take the cross towards 1.0750 over the next few weeks.

AUDNZD Strangle Shorts: Spot reference: 1.0565 levels, contemplating the major trend that has been range-bounded (oscillating between 1.1425 and 1.0025 levels), it is wise to deploy (0.5%) out-of-the-money call and (0.5%) out-of-the-money put options of the 1m tenor. The strategy can be executed at the net credit and certain yields would be derived in the form of the initial premium received as long as the underlying spot FX remains between OTM strikes on the expiration.

3-Way Straddles Versus ITM Puts: Considering non-directional movements in the underlying spot FX (refer above chart), 3-way straddles are advocated, the strategy comprises of at the money +0.51 delta call, at the money -0.49 delta put options and short in the money put options of narrowed expiry with a view of arresting potential FX risks on either side but capitalizing on minor upswings in the near-term. Hence, on hedging grounds, buy 2m ATM delta puts and ATM delta call of similar tenor and short (1%) in the money put options of 1w are advocated.

Currency Strength Index: FxWirePro's hourly AUD spot index is inching towards -93 levels (which is bearish), while hourly NZD spot index was at -41 (bearish) while articulating (at 07:54 GMT).

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025